Online advertising technology firm Magnite Inc. (NASDAQ: MGNI) recently revealed that it has acquired Carbon, a platform that enables publishers to measure, manage and monetize audiences in real-time. The financial terms of the deal have been kept under wraps.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the news, shares of the company rose 3% on Monday. Further, the stock rose 1% in the extended trading session to close at $14.72.

Strategic Impact

Magnite’s aim of bolstering its seller-first, privacy-focused identity and audience solutions is likely to receive a boost with this acquisition.

Further, the combination of Magnite’s scale and global footprint is expected to make the process of finding audiences for media owners and advertisers easier and more efficient.

Management Commentary

The Chief Product Officer at Magnite, Adam Soroca, said, “We believe seller-defined audiences will be a core part of the future of identity and addressability. CTV sellers have valuable viewer data that makes them well-positioned to create unique first-party data and we expect their demands around addressability to become more pronounced. As it relates to the open web, the likely deprecation of the third-party cookie means publisher-centric identity solutions are foundational to the future of advertising.”

Stock Rating

Recently, Craig-Hallum analyst Jason Kreyer reiterated a Buy rating on the stock. The analyst, however, lowered the price target from $45 to $25, which implies upside potential of 71.5% from current levels.

Consensus among analysts is a Strong Buy based on 6 Buys and 1 Hold. The average Magnite price target of $24 implies upside potential of 64.6% from current levels. Shares have declined 72.1% over the past year.

News Sentiment

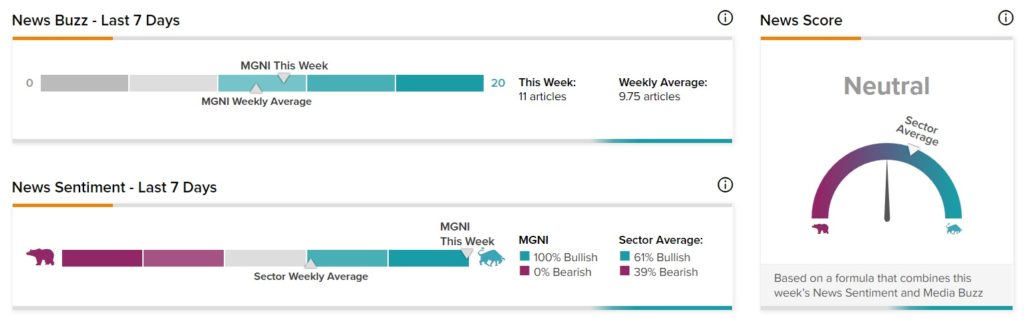

News Sentiment for MGNI is Neutral based on 11 articles over the past seven days. 100% of the articles have Bullish sentiment, compared to a sector average of 61%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

TD Bank Buys First Horizon

Chevron Enters All-Cash Deal to Acquire Renewable Energy Group

Cinemark Holdings’ Q4 Results Exceed Expectations