Magnet Forensics (TSE: MAGT), a digital investigation software company, recently reported its Q3-2022 results. Magnet’s results beat revenue expectations but missed earnings-per-share (EPS) estimates. Nonetheless, the company is growing at a rapid pace, and the earnings report was good enough to send the stock soaring. Please note that the following figures are in U.S. dollars unless otherwise stated.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

MAGT’s revenue rose to $25 million (a 41% year-over-year increase), which beat expectations of $23.93 million. Notably, its annual recurring revenue grew by 50% to $80.9 million.

However, its adjusted earnings per share were $0.03, less than the $0.05 consensus estimate ($0.07 in Canadian dollars). This is also lower than last year’s EPS of $0.05.

Still, Magnet Forensics’ adjusted EBITDA rose 25% year-over-year to $5.9 million, and the company’s gross profit margin stayed at a very high 93%.

Regarding cash flow from operations for the nine months ended September 30, it was $8.52 million compared to ~$9.05 million in the same period last year. The company’s cash position also increased by 3.55% to $122.3 million while having negligible debt.

Lastly, the company provided full-year 2022 guidance. Revenue is expected to grow by 37% to 39%, reaching $96 million to $98 million, and adjusted EBITDA is forecast to be $16 million to $19 million compared to $14.9 million last year.

Is Magnet Forensics Stock a Buy, According to Analysts?

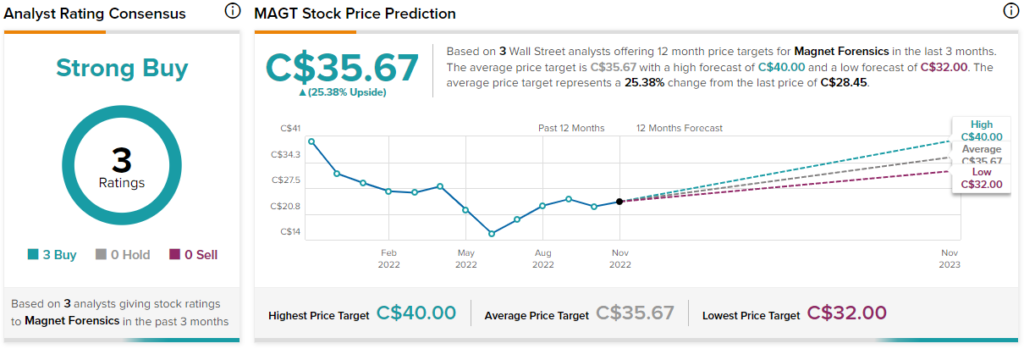

According to analysts, Magnet Forensics has a Strong Buy consensus rating based on three Buys assigned in the past three months. The average Magnet Forensics price target of C$35.67 implies 25.4% upside potential.

Conclusion: Magnet’s Earnings Report Was Mixed but Solid

Operating in a resilient industry, Magnet Forensics’ business is still performing relatively well in the current environment. While the earnings report was mixed, the company is still experiencing high growth while maintaining profitability – something that many companies find hard to achieve.