Vista Outdoor (NYSE:VSTO) has received a revised offer from MNC Capital to acquire all the outstanding shares of the company for $42 per share, or around $3.2 billion. MNC’s revised offer represents a 55% premium over the volume-weighted average price (VWAP) from Vista’s deal announcement with CSG on October 16, 2023, to the last closing price before MNC’s initial offer on February 19, 2024. It also represents over a 40% premium to the last closing price before MNC’s initial offer.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

MNC Capital’s Bid For VSTO

Vista, the manufacturer of outdoor sports and recreation products, rejected MNC Capital’s earlier offer of $37.50 per share, stating that the offer “significantly” undervalued the company. As a result, MNC later raised the offer for VSTO to $39.50 per share and subsequently to its current offer of $42 per share.

MNC has stated that it sees no “possible basis or reason to further raise it [the offer].” MNC’s revised offer comes just as Vista has decided to sell its Kinetic Group business. Kinetic Group is VSTO’s sporting products business.

VSTO’s Sale of the Kinetic Group Business

VSTO has decided to sell its Kinetic Group business to the Czechoslovak Group (CSG) for $2 billion. With this sell-off, Vista is finally completing the separation of its outdoor sports and recreation products businesses.

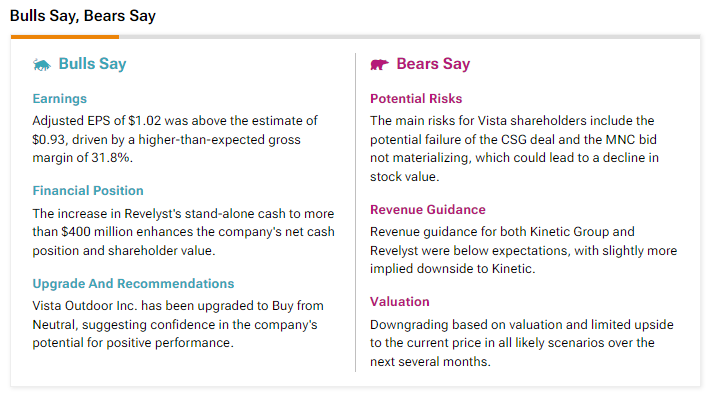

As a result of the sale of the company’s Kinetic Group business and the improved offer from MNC Capital, Vista has mitigated a potential risk for the stock. According to the TipRanks “Bulls Say, Bears Say,” analysts bearish on VSTO stock had highlighted this potential risk and commented, “The potential failure of the CSG deal and the MNC bid not materializing could lead to a decline in stock value.”

Is VSTO a Good Buy?

Analysts remain cautiously optimistic about VSTO stock, with a Moderate Buy consensus rating based on two Buys and one Hold. Over the past year, VSTO has increased by more than 20%, and the average VSTO price target of $40 implies an upside potential of 18.4% from current levels.