Packaging solutions provider Sonoco Products (NYSE:SON) is acquiring European food cans producer Eviosys for $3.9 billion. The transaction promises to create a leading metal food can and aerosol packaging platform globally.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The Acquisition

The deal is part of Sonoco’s overarching strategy focused on scale and its core businesses. Eviosys’ solutions include metal packaging, food cans, aerosol cans, metal closures, and promotional packaging for consumer brands. The company has the largest metal food can production presence in the EMEA region, with 44 facilities in 17 countries.

Eviosys is expected to generate an adjusted EBITDA of $430 million on $2.5 billion in revenue this year. Notably, the company has grown its EBITDA by nearly 50% since 2021. The $3.9 billion acquisition tag implies a 7.3x multiple over Eviosys’ adjusted EBITDA for 2024.

Furthermore, the acquisition is anticipated to result in $100 million in synergies and increase Sonoco’s 2025 bottom line by over 25%. Importantly, this transaction builds on Sonoco’s 2022 acquisition of Ball Metalpack, further strengthening its position in the market.

Sonoco’s Focus on Core Operations

Separately, Sonoco plans to divest its ThermoSafe packaging business, along with other units. The company expects to generate at least $1 billion from these divestments over the next 12-18 months. This effort is part of Sonoco’s strategy to focus on its core operations.

What Is the Target Price for Sonoco Products?

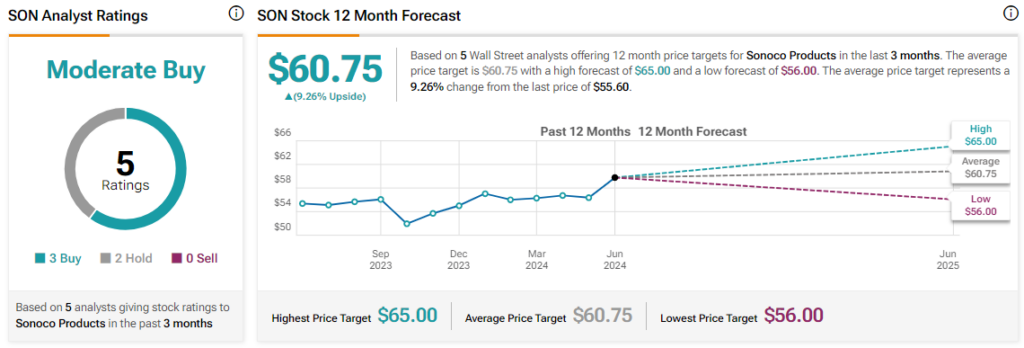

Sonoco’s share price has remained largely flat over the past year. Overall, the Street has a Moderate Buy consensus rating on the stock, alongside an average SON price target of $60.75.

Read full Disclosure