Rio Tinto (RIO) (AU:RIO) has agreed to buy lithium producer Arcadium Lithium PLC (ALTM) for $6.7 billion, re-enforcing its emphasis on lithium mining. The Anglo-Australian mining company is offering $5.85 per ALTM share. The cash offer represents a nearly 90% premium to ALTM’s closing price of $3.08 on October 4. The definitive agreement followed reports of Rio Tinto’s interest in ALTM, sparked two days ago. The deal makes Rio Tinto one of the top three lithium producers in the world.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The deal has been approved by the boards of both companies and is expected to close in mid-2025, subject to Arcadium shareholders’ approval and other closing conditions. Rio’s CEO Jakob Stausholm called the acquisition “counter-cyclical expansion” and an opportunity to gain exposure to a high-growth, lucrative market.

Here’s Why Rio Tinto is Buying Arcadium Lithium

Rio Tinto believes the timing of ALTM’s acquisition is crucial amid falling lithium prices, which have dropped over 80% from their peaks. Instead of developing its own lithium mining facilities, for which earlier attempts have failed, acquiring an existing miner proves more beneficial. Arcadium Lithium has mining operations and processing facilities in Argentina, Australia, the U.S., China, Japan, and the UK.

The growing importance of lithium in the manufacturing of EV (electric vehicle) batteries has compelled several mining companies to refocus their operations on the rare metal. The increasing pressure from governments worldwide toward meeting decarbonization goals has made EVs a crucial aspect of the auto industry.

Rio Tinto is anticipating that the demand for lithium will surge in the coming years as a crucial element in manufacturing batteries for EVs and solar storage systems. However, it is difficult to project demand for lithium as the EV market has seen a declining trend in recent months and an oversupply from China has dampened prices. Having said that, Rio Tinto will be ready to leverage its major lithium offerings once demand for EVs recovers.

Is Rio Tinto Stock a Good Buy?

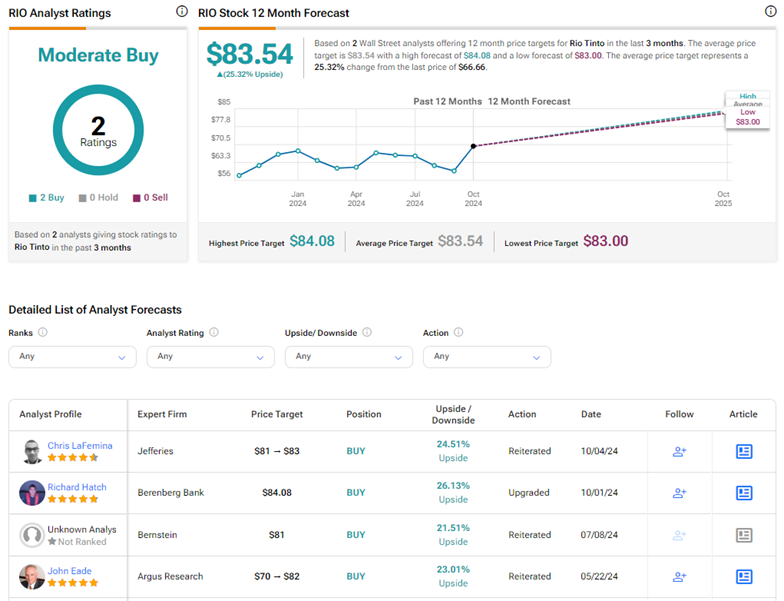

On TipRanks, RIO stock has a Moderate Buy consensus rating based on two Buy ratings received in the past three months. Also, the average Rio Tinto price target of $83.54 implies 25.3% upside potential from current levels. Year-to-date, RIO shares have lost 4.1%.