Alaska Air (ALK) and Hawaiian Airlines have received the green light from the Transportation Department for their $1 billion merger, but with crucial conditions attached. This deal, which Alaska announced late last year, is set to reshape the airline industry. The Wall Street Journal reports that this deal is the first major U.S. airline merger since Alaska’s acquisition of Virgin America in 2016.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Transportation Department Sets Stringent Conditions

The Transportation Department’s approval is not a free pass. According to Reuters, the department has mandated that the airlines maintain service on essential routes between the Hawaiian Islands and key U.S. destinations. They also need to preserve frequent-flier mile values and ensure compensation for flight delays or cancellations within the airlines’ control. “We are committed to upholding these conditions to benefit our passengers,” said Alaska Air’s spokesperson, reflecting the company’s alignment with the department’s requirements.

Leadership Shifts as Merger Finalizes

Once the deal closes, expected soon, Hawaiian Airlines’ CEO Peter Ingram will step down, with Joe Sprague of Alaska’s Hawai’i/Pacific region stepping into the role. This leadership change aims to ensure a smooth transition and integration, aligning with both airlines’ strategic goals.

Merger Gives Control of the Hawaiian Air Travel Market

The merger will give the combined airline a substantial presence, controlling 50% of the Hawaiian air-travel market. The Transportation Department has also ensured that customer protections, like guaranteeing that children sit next to accompanying adults at no extra cost, are upheld for six years post-merger. This careful oversight aims to address concerns about potential service reductions and loyalty program impacts.

Is ALK a Good Stock to Buy Now?

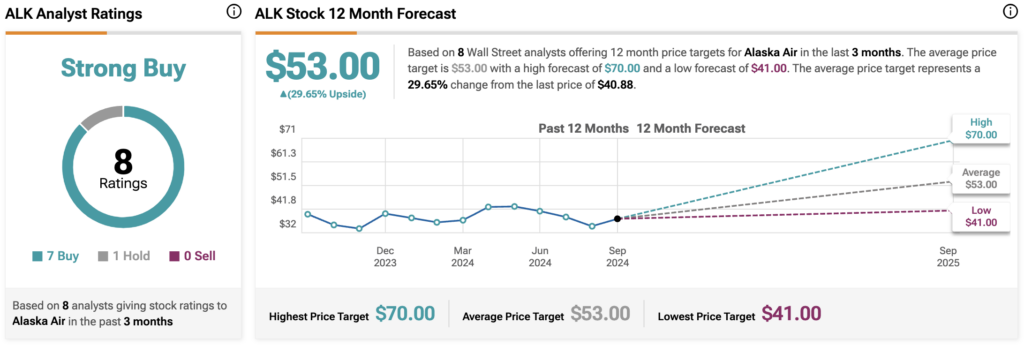

Analysts remain bullish about ALK stock, with a Strong Buy consensus rating based on seven Buys and one Hold. Over the past year, ALK has surged by more than 5%, and the average ALK price target of $53.00 implies an upside potential of 29.7% from current levels.