Investors can track the investment decisions of leading financial experts with TipRanks’ Top Hedge Fund Managers. The tool ranks these professionals based on success rates, average returns, and the significance of their trades. In this article, we will focus on the three top picks – Mastercard (NYSE:MA), Moody’s (NYSE:MCO), and American Tower (NYSE:AMT) – of the leading hedge fund manager Chuck Akre of Akre Capital Management LLC.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

According to the rankings, Akre holds the 13th spot among the 483 hedge fund managers evaluated by TipRanks. It should be noted that he has delivered exceptional performance, with a cumulative gain of 240.9% since June 2013 and an average return of 31.08% over the past 12 months.

Additionally, a hedge fund manager’s return on a portfolio is best measured by the Sharpe ratio, which measures the portfolio’s returns against its risks. A Sharpe ratio greater than one means that the portfolio has higher returns than risks. Akre has a Sharpe ratio of 4.13.

With this background, let’s explore what the Street is saying about Akre’s top picks.

Is MA a Good Stock to Buy Now?

Mastercard is a global payment technology company that facilitates electronic fund transfers. With an exposure of 18.11%, MA occupies the first position in Akre’s portfolio.

Importantly, two Top analysts rated the stock a Buy earlier this week. Analyst Bryan Bergin from TD Cowen considers MA a high-growth, high-margin play in the massive payments industry. Also, he sees potential for mid-teen earnings growth, thanks to continued investment in AI and new products.

Overall, MA has a Strong Buy consensus rating on TipRanks, based on 28 Buys and one Hold. Further, the analysts’ average price target on Mastercard stock of $515 implies a 9.97% upside potential to current levels. Shares of the company have gained 10.13% year-to-date.

Is MCO Stock a Buy?

Moody’s provides credit ratings, research, and risk analysis services for financial markets. MCO is the second-largest holding in Akre’s portfolio, with an exposure of about 15.66%.

Interestingly, three Top-rated analysts gave a Buy rating to the stock. Oppenheimer analyst Owen Lau holds a positive view of the company due to its strong competitive edge.

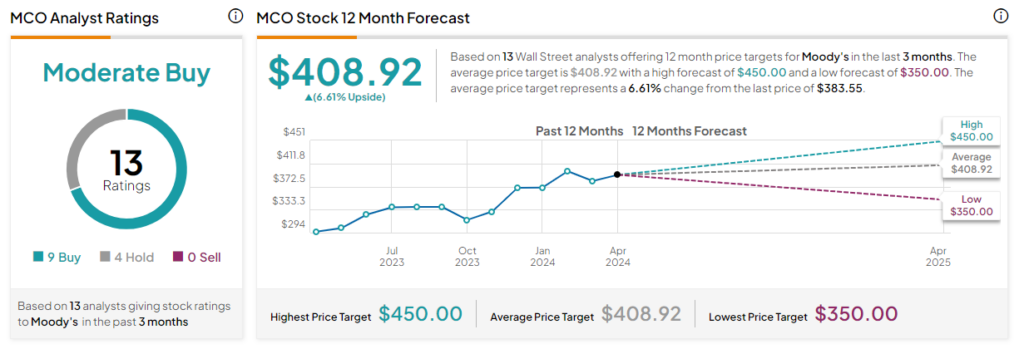

With nine Buy and four Hold ratings, Moody’s has a Moderate Buy consensus rating. On TipRanks, the analysts’ average price target on MCO stock of $408.92 implies 6.61% upside potential from current levels. Over the past six months, shares of the company have gained 20.4%.

Interestingly, Moody’s stock has a Smart Score of “Perfect 10” on TipRanks. Note that shares with a “Perfect 10” Smart Score have historically outperformed the S&P 500 Index (SPX).

Is AMT a Buy?

American Tower is a real estate investment trust (REIT) that owns and operates telecommunications infrastructure, including cell towers and distributed antenna systems. AMT stock constitutes 12.36% of Akre’s portfolio.

In the past seven days, the stock has been rated a Buy by three Wall Street analysts. Ari Klein, an analyst from BMO Capital, is optimistic about the company’s diversified tower portfolio and expects investments in data centers to drive growth in the near term.

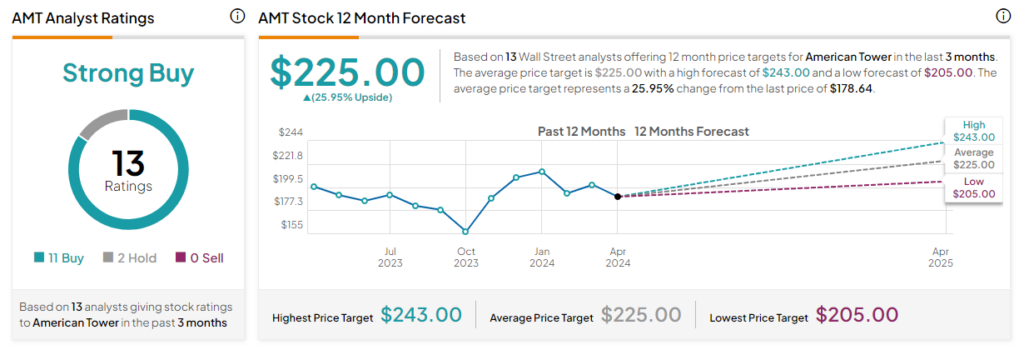

On TipRanks, American Tower has a Strong Buy consensus rating. This is based on 11 Buy and two Hold recommendations. The analysts’ average price target of $225 implies 25.95% upside potential. Shares of the company have gained 9.6% over the past six months.

Concluding Thoughts

Akre’s consistent record of generating high returns could encourage investors to adopt his portfolio allocation strategy. By following the guidance of Top experts, investors can leverage their knowledge and make well-informed decisions.