Mastercard’s (MA) third-quarter earnings in 2024 brought some serious momentum, with the company delivering robust revenue growth and beating analyst expectations. The payments giant reported a revenue of $7.4 billion, marking a 13% rise year-over-year (14% on a currency-neutral basis, above analysts’ expectations of $7.3 billion. Adjusted net income reached $3.6 billion, and EPS came in at $3.89—both metrics reflecting healthy consumer spending and demand for Mastercard’s services.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Mastercard’s EPS Surpasses Expectations

One of the most eye-catching figures was Mastercard’s EPS at $3.89, adjusted for one-time items, which clearly outpaced analysts’ consensus estimate of $3.74. EPS growth signals not only efficient operational management but also the strength of Mastercard’s platform in an environment of rising costs and competition. CEO Michael Miebach praised the “strength of our platform,” adding that the company’s robust consumer spending base drove its third-quarter achievements.

MA’s Revenue Driven by Consumer Demand and International Activity

Mastercard’s payment network saw a substantial boost, with gross dollar volume up 10% to $2.5 trillion. Cross-border volumes grew 17% year-over-year, indicating a return to travel and international transactions, which are key revenue drivers. The company also noted a surge in switched transactions—up 11% year-over-year, fueled by an increase in global consumer spending on digital services and products.

According to Mastercard, the company’s value-added services, such as consulting, fraud detection, and security, experienced an 18% rise in revenue, catering to banks and retailers eager for comprehensive digital payment solutions. This growth in demand shows how Mastercard is successfully expanding its business model beyond traditional transactions, a trend Miebach believes will continue with planned acquisitions of AI-driven firms like Recorded Future and Minna Technologies.

Mastercard’s Share Buybacks Show Confidence

In Q3 alone, Mastercard repurchased 6.3 million shares for $2.9 billion, returning capital to shareholders. By October 28, Mastercard spent nearly $983 million on further share buybacks, leaving $5.6 billion available under its current repurchase programs. Such aggressive buybacks showcase Mastercard’s confidence in its long-term growth and profitability, offering a strong signal to investors about future performance.

Is MA Stock a Buy, Sell or Hold?

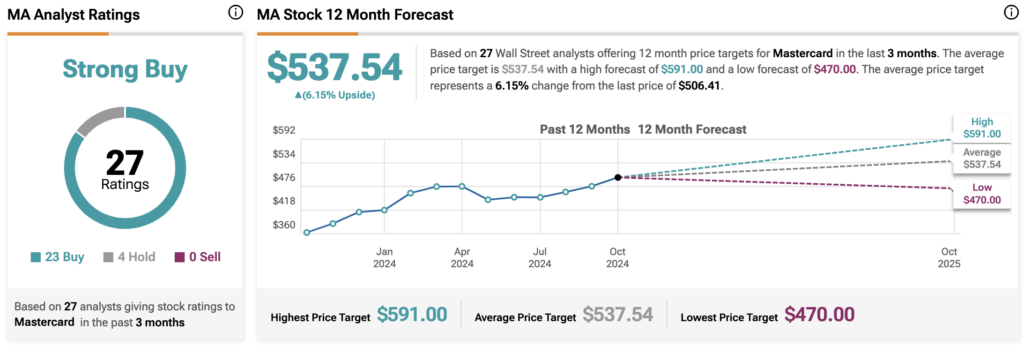

Analysts remain bullish about MA stock, with a Strong Buy consensus rating based on 23 Buys and four Holds. Over the past year, MA has increased by more than 35%, and the average MA price target of $537.54 implies an upside potential of 6.2% from current levels. These analyst ratings are likely to change following MA’s results today.