Shares of PGT Innovations (NYSE:PGTI) jumped nearly 5% in the early session today after the provider of windows and doors received an unsolicited proposal from Miter Brands to acquire all of its outstanding shares at $41.50 per share in cash.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The offer from Miter comes after PGTI agreed to be acquired last month by Masonite International (NYSE:DOOR) for $41 per share. Masonite is a leading name in the production of doors and door systems. The combination of PGTI and Masonite is expected to improve manufacturing capabilities, drive geographic expansion, and create synergies for the company.

The higher bid from Miter comes after earlier reports indicated that its previous $38 per share bid was rejected by PGTI. However, PGTI’s Board is now reviewing Miter’s latest M&A proposal to determine “If it is reasonably likely to lead to a superior proposal.”

What is the Target Price for PGTI Stock?

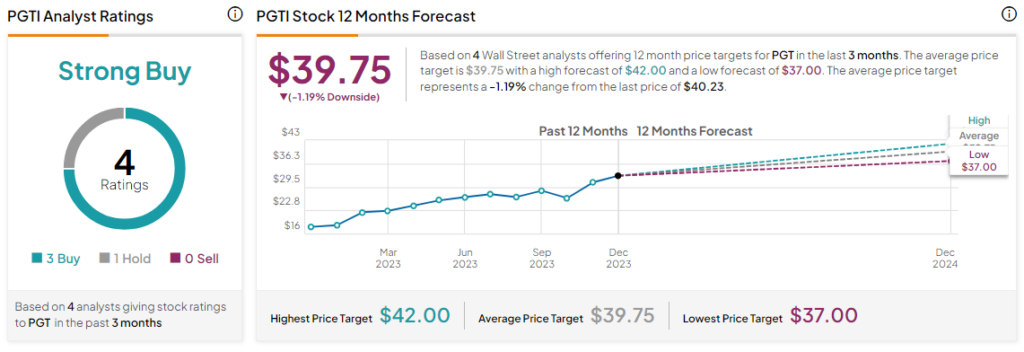

Meanwhile, PGTI investors are already sitting on returns of nearly 127% over the past year. Overall, the Street has a Strong Buy consensus rating on PGT Innovations, and the average PGTI price target of $39.75 implies that the stock may be fairly priced at current levels. In contrast, DOOR shares have gained a modest 5% during this period.

Read full Disclosure