Callon Petroleum (NYSE:CPE) shares soared over 5% in the early session today after the oil and gas company agreed to be acquired by APA Corp. (NASDAQ:APA) in an all-stock deal worth $4.5 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

According to deal terms, each Callon share will be exchanged at a fixed ratio of 1.0425 APA shares. This strategic M & A move complements APA’s assets in the Permian Basin and is anticipated to be accretive to its key financial metrics. Further, the deal is expected to boost APA’s oil-prone acreage in the Midland and Delaware Basin by over 50%.

Additionally, increased scale is expected to help APA realize overhead and cost-of-capital synergies to the tune of over $150 million. The exchange ratio points to a value of $38.31 per Callon share based on APA’s January 3 closing price. Further, APA will issue 70 million shares and its investors are expected to own nearly 81% of the combined entity.

The deal has been unanimously approved by the Boards of both companies and is anticipated to close in the second quarter of this year. Upon closing, APA’s pro forma global production mix will be about 64% in the U.S. and 36% internationally. Further, the deal takes production for the combined entity to over 500,000 BOE per day.

Is APA a Good Stock to Buy?

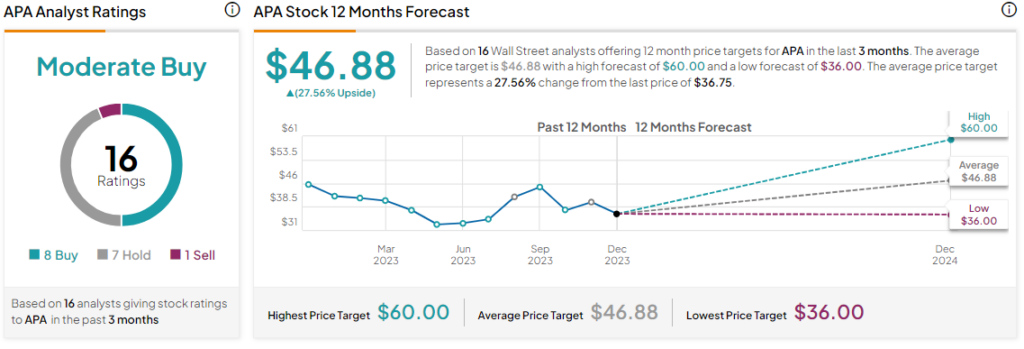

While CPE shares are surging, APA shares are already down over 5% today. Overall, the Street has a Moderate Buy consensus rating on APA Corp., and the average APA price target of $46.88 points to a 27.6% potential upside in the stock.

Read full Disclosure