Lyft (LYFT), as ride-hailing services go, is often considered an also-ran to Uber (UBER), its more successful competitor. But Lyft is not going away, and it recently inked a deal with Mobileye (MBLY) to help bring itself back to some kind of prominence. The move was welcomed by investors, who sent shares surging nearly 5%.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The deal with Mobileye looks to bring robotaxi service to Lyft’s operations, allowing “third-party fleet operators” to bring in self-driving cars and run them under the ride-hailing service’s operational platform. Basically, robots are about to become Lyft drivers, thanks to that technology.

It already plans to bring self-driving taxi service to Atlanta, Georgia, which will be available starting in 2025. Further, Lyft will also be working with Nexar, providing data and video footage that will help it develop new tools for autonomous vehicles. This is not unique to Lyft as Uber has been making inroads on this front for some time as well.

Legal Troubles

On another front, trouble is brewing at Lyft in the form of a $2.1 million fine from the Federal Trade Commission (FTC) over just how much drivers can actually make on the platform. Lyft promotions drawing workers in based on the top 5% of its drivers, which in turn left the average worker overestimating his or her potential earnings by as much as 30%.

Is Lyft Stock a Buy?

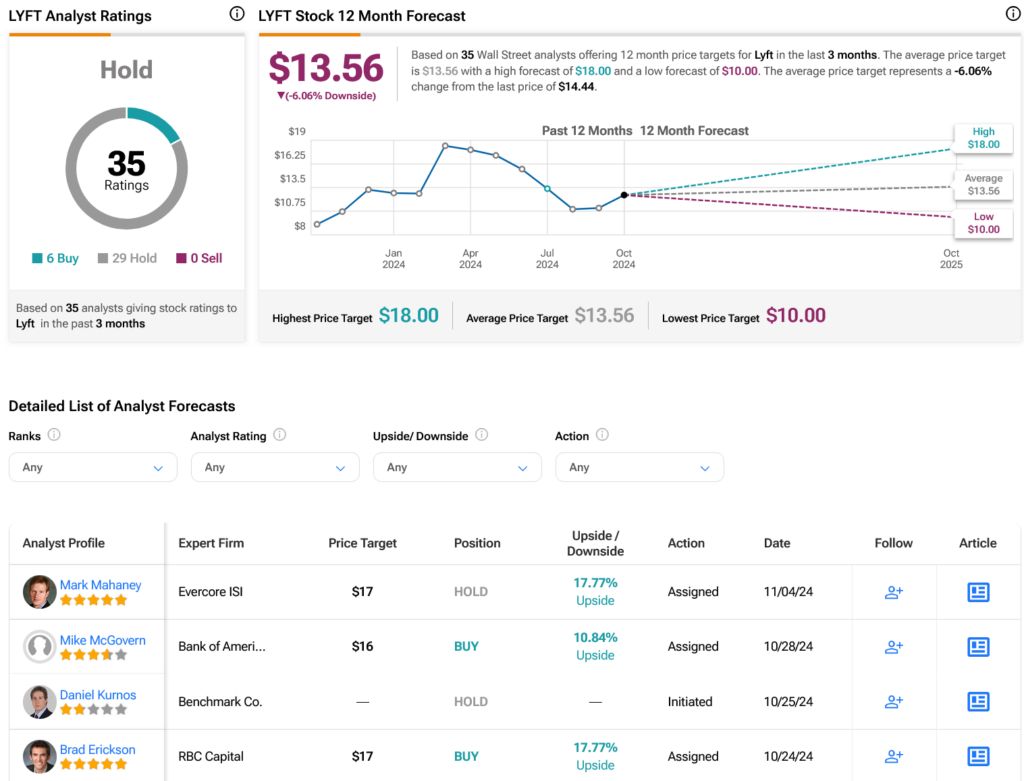

Turning to Wall Street, analysts have a Hold consensus rating on LYFT stock based on six Buys and 29 Holds assigned in the past three months, as indicated by the graphic below. After a 33.29% rally in its share price over the past year, the average LYFT price target of $13.56 implies 6.06% downside risk.