In a major restructuring move, Lyft (LYFT) announced that it will discontinue standalone dockless bikes and scooters and implement job cuts aimed at reducing costs. The ride-sharing company, known for operating the Citibike service in New York City and similar programs in other U.S. cities, had previously stated that it was considering options for the unit after receiving significant interest.

Details of LYFT’s Restructuring Plan

As a part of this restructuring, Lyft intends to end its dockless scooter operations in Washington, D.C., and explore alternatives for its dockless bikes and scooters in Denver. This move includes rebranding its bikes and scooters division as “Lyft Urban Solutions.”

Notably, Lyft does not operate its own bikes and scooters in many U.S. cities. Instead, it has entered into partnerships with companies like Bird and Spin, allowing users to access their vehicles through the Lyft app.

As a result of this restructuring, Lyft expects to incur charges ranging from $34 million to $46 million, primarily due to asset disposal costs. Additionally, the company plans to lay off approximately 1% of its nearly 3,000 employees.

Lyft Expects Cost-Saving Measures to Pay Off

Lyft anticipates that these cost-saving measures, alongside operational improvements and enhanced sales strategies, will increase its adjusted operating income by about $20 million annually by the end of next year.

Lyft could use this income boost, especially after last month, when it projected a weak performance for the September quarter. This raised concerns about its ability to compete with Uber Technologies (UBER).

Is Lyft Stock a Buy Now?

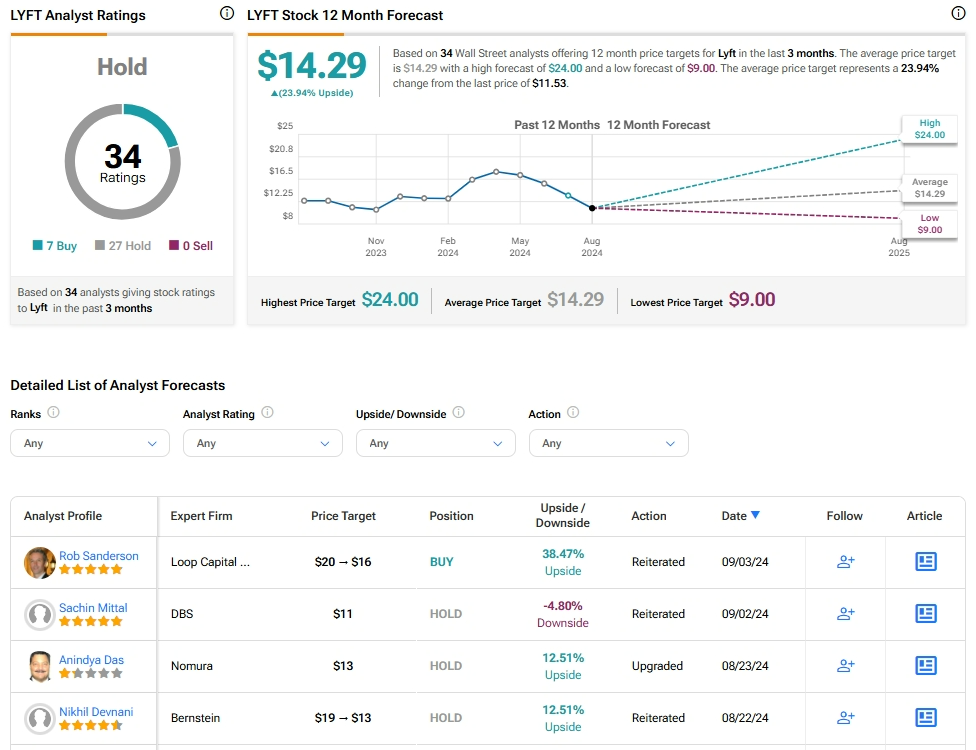

Analysts remain sidelined about Lyft stock, with a Hold consensus rating based on seven Buys and 27 Holds. Year-to-date, Lyft has declined by more than 20%, and the average Lyft price target of $14.29 implies an upside potential of 23.9% from current levels.