Lyft (LYFT), a player in the on-demand ridesharing market, continues to make strides in the industry. The company exceeded expectations with strong growth in Q3 2024, recording record levels of active riders and rides taken, with an increase of 9% and 16% year-over-year, respectively. Partnerships with Mobileye (MBLY), May Mobility, and Nexar to offer autonomous vehicle services and a new alliance with DoorDash that aims to provide exclusive benefits to DashPass members suggest further upside potential. Despite facing a net loss of $12.4 million in Q3 2024, Lyft’s optimistic Q4 2024 outlook forecasts gross bookings to grow by 15%-17% year-over-year and an adjusted EBITDA margin of approximately 2.3%-2.4%.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The ongoing developments in autonomous vehicles by companies like Alphabet’s (GOOG) Waymo and Tesla (TSLA) pose a challenge. Still, Lyft’s active preparations for a future with autonomous cabs keep it firmly in the game.

A Potential Acquisition Target

Lyft is a key player in the on-demand ridesharing market. It operates via a peer-to-peer marketplace and provides access to various transport options through the Lyft platform and mobile apps. The company’s portfolio includes a ridesharing marketplace linking drivers and riders and Express Drive, a rental program for drivers.

The company announced a strategic alliance with DoorDash, partnering with DashPass to offer rides and local delivery benefits for DashPass members and eligible Lyft riders. Users can enjoy exclusive monthly benefits, such as discounts on Lyft rides, free Priority Pickup upgrades, and a free trial for new DashPass members.

The rise of robotaxis, supported by companies such as Waymo and Tesla, threatens to disrupt existing ride-hailing services. Waymo, backed by Alphabet, has completed over 100,000 paid weekly rides. Meanwhile, Lyft’s competitor, Uber (UBER), has been preparing for a future with autonomous cabs. Lyft is currently facing challenges that are making it a potential acquisition target. Analysts predict that Amazon (AMZN) could acquire Lyft, leveraging the Zoox robotaxis to compete with Waymo and potentially expanding the service to include autonomous Amazon delivery vehicles.

Projecting Growth for Q4 and FY2024

The company reported results for Q3 2024, with gross bookings reaching $4.1 billion, a 16% increase from the previous year. Revenue followed a similar trend, rising by 32% year-over-year to $1.5 billion. Notably, a net loss of $12.4 million was reported during this period. Adjusted EBITDA was $107.3 million, compared to $92.0 million in Q3’23, while net cash provided by operating activities rose dramatically to $264.0 million compared to just $2.3 million the previous year.

Management has given guidance for Q4. Gross bookings are expected to vary between $4.28 billion and $4.35 billion, marking a 15% to 17% year-over-year increase. The anticipated adjusted EBITDA is between $100 million and $105 million, with an adjusted EBITDA margin of approximately 2.3% to 2.4% of Gross Bookings.

Updated forecasts for the 2024 project year-over-year growth in rides in the mid-teens and gross bookings to grow by approximately 17%. The adjusted EBITDA margin is predicted to rise to 2.3% from the previous outlook of 2.1%. Further, we expect free cash flow to exceed $650 million.

Analysts Are Cautious

The stock has been volatile, with a beta of 2.57, as it bounced around over the past year, finally finishing up over 6%. It trades near the middle of its 52-week price range of $8.93 – $20.82 and shows ongoing negative price momentum as it trades below the major moving averages. It appears to be trading at a discount with a P/S ratio of 0.99x compared to the Industrials sector average of 1.57x.

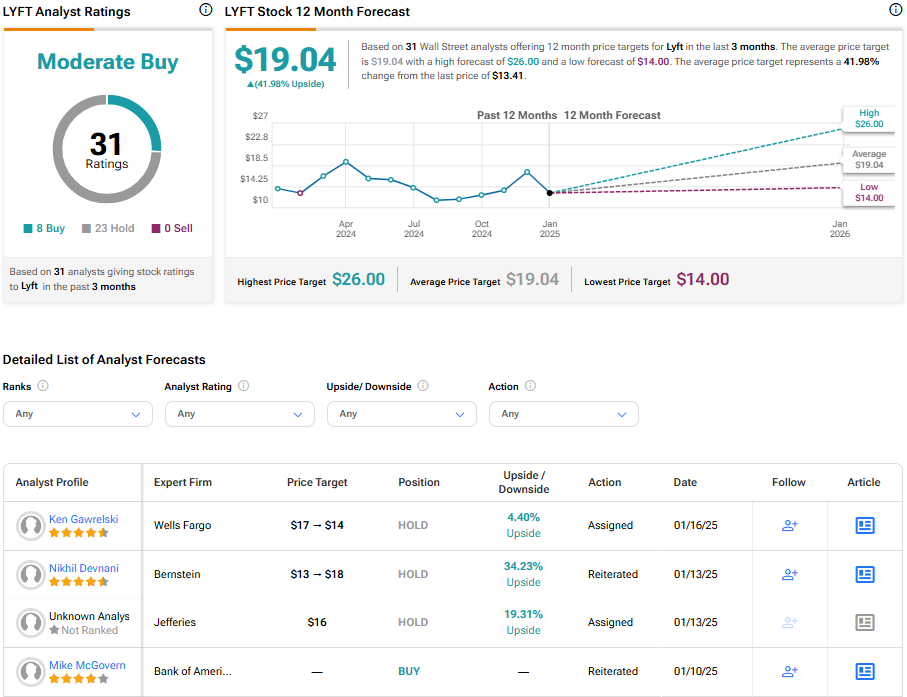

Analysts following the company have taken a cautious stance on LYFT stock. For example, Cantor Fitzgerald’s Deepak Mathivanan, a five-star analyst according to Tipranks’ ratings, recently reiterated a Neutral rating while lowering the price target on the shares to $15 (from $16), noting expectations for a backdrop of strong growth and margin expansion in 2025.

Lyft is rated a Moderate Buy overall, based on the recent recommendations of 31 analysts. Their average price target for LYFT stock is $19.04, which represents a potential upside of 41.98% from current levels.

Bottom Line on Lyft

Lyft has demonstrated growth in recent quarters and is setting an optimistic tone for the future. This optimism is fueled by partnerships in the autonomous vehicle sector and a fruitful alliance with DoorDash that promises to deliver exclusive benefits to DashPass members. Challenges on the horizon—such as competition from autonomous vehicle advancements by other industry bigwigs—have analysts advising a cautious approach to the stock.