Tech giant Google (GOOGL) is set to face charges from the European Commission for allegedly breaking EU rules. According to Reuters, the charges are related to Google’s search results, which the EU says favor Google’s own services over those of its rivals. This is a big deal, as Google is one of the most widely used search engines in the world.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The EU has been investigating Google since last March to see if it is giving its own services, like Google Shopping and Google Hotels, preferential treatment. EU rules, known as the Digital Markets Act, say that big tech companies like Google cannot favor their own services over others. The idea is to create a level playing field where all companies have an equal chance to succeed.

Google has tried to address these concerns by making some changes to its search results. However, its rivals and EU regulators aren’t satisfied with these efforts. Therefore, the EU is expected to formally charge Google in the coming months. If found guilty, Google could face significant fines of up to 10% of its global annual revenue.

Is Google Stock a Good Buy?

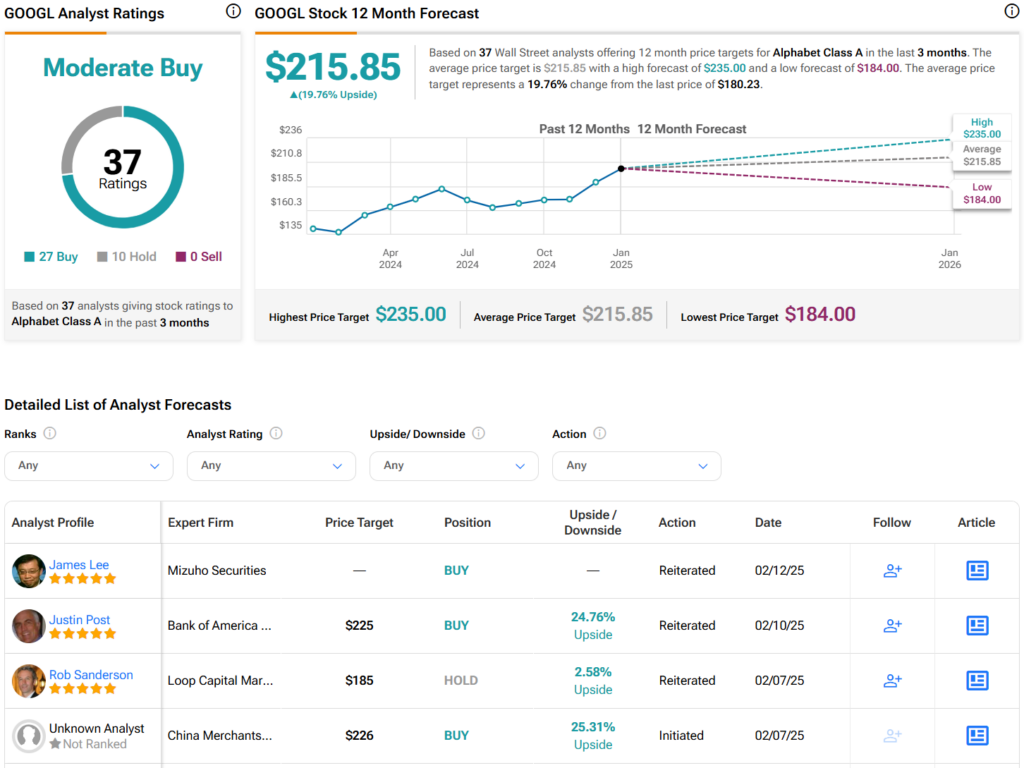

Turning to Wall Street, analysts have a Moderate Buy consensus rating on GOOGL stock based on 27 Buys and 10 Holds assigned in the past three months. After a 25% rally in the past 12 months, the average GOOGL price target of $215.85 per share implies 19.8% upside potential from current levels.