Lucid Group (LCID) has ambitious plans for the electric vehicle market, yet operational and financial concerns have clouded investor confidence. The company’s recent public offering and additional issuance to its largest shareholder, the Saudi Arabian government’s sovereign wealth fund, have led to significant share dilution for other investors. The market quickly responded as shares dropped over 20% on the news.

Furthermore, Lucid’s Q3 production and delivery results fell short of expectations, signaling potential turbulence ahead. Despite revenue growth, losses are expected to widen, casting further doubt on the sustainability of the company’s upward trajectory. While additional financial support from Saudi Arabia may help Lucid stay afloat in the short term, fundamental issues regarding the company’s ability to generate sufficient sales and profits to justify its high valuation suggest stormy weather.

It is difficult to see a profitable path forward for the company, compounded by the risk of its primary patron eventually deciding to throw in the towel. Due to the absence of bullish catalysts, dilutive effects of share sales, stalled growth, lack of profits, and an unusually high valuation, investors may want to avoid LCID for the time being.

Lucid Raising Capital Yet Again

Lucid Group is a technology and automotive company committed to designing, developing, manufacturing, and selling electric vehicles (EVs), EV powertrains, and battery systems.

The company aims to capture market share in the luxury car segment of the electric vehicle industry with its lead product – the Lucid Air, which is manufactured at its Casa Grande, Arizona facility. The company has outlined an ambitious product roadmap for future vehicles and technologies underpinned by in-house innovation and vertical integration.

Lucid recently announced a public offering of 262 million shares of its common stock. Simultaneously, an agreement was reached between Lucid and its majority stockholder, Ayar Third Investment Company, the Saudi Arabian Public Investment Fund affiliate. Under this agreement, Ayar committed to purchasing 374 million shares of Lucid’s common stock in a private placement at the same rate as the underwritten price in the public offering.

This purchase will ensure its continued ownership of approximately 58.8% of Lucid’s outstanding common stock. The revenue from both the public and private offerings will be used for general corporate purposes such as capital expenditures and working capital.

Analysis of Lucid’s Recent Results

The company recently announced production results for the third quarter of 2024. The company manufactured 1,805 vehicles and delivered 2,781 units, surpassing analysts’ previous delivery estimates; however, the production numbers fell short of the projected 2,267 vehicles.

Moreover, compared to the last quarter, production numbers have declined from the 2,110 units produced and 2,394 delivered in Q2. The company expects to announce its Q3 2024 financial results on November 7, 2024, with an estimated loss of $0.29 per share on revenue of $183.14 million.

Is LCID a Buy?

The stock has been on an extended downturn, shedding over 90% in the past three years. It trades near the bottom of its 52-week price range of $2.29 – $5.31 and continues to show ongoing negative price momentum by trading below its 20-day (3.28) and 50-day (3.39) moving averages.

Despite the decline in share price, it still appears to trade at a significant premium over industry peers, with a P/S ratio of 9x compared to the Auto Manufacturers’ average of 0.75x. Further, LCID continues to face high short interest, currently at approximately 20%, a decrease from its historical peak but still significantly high.

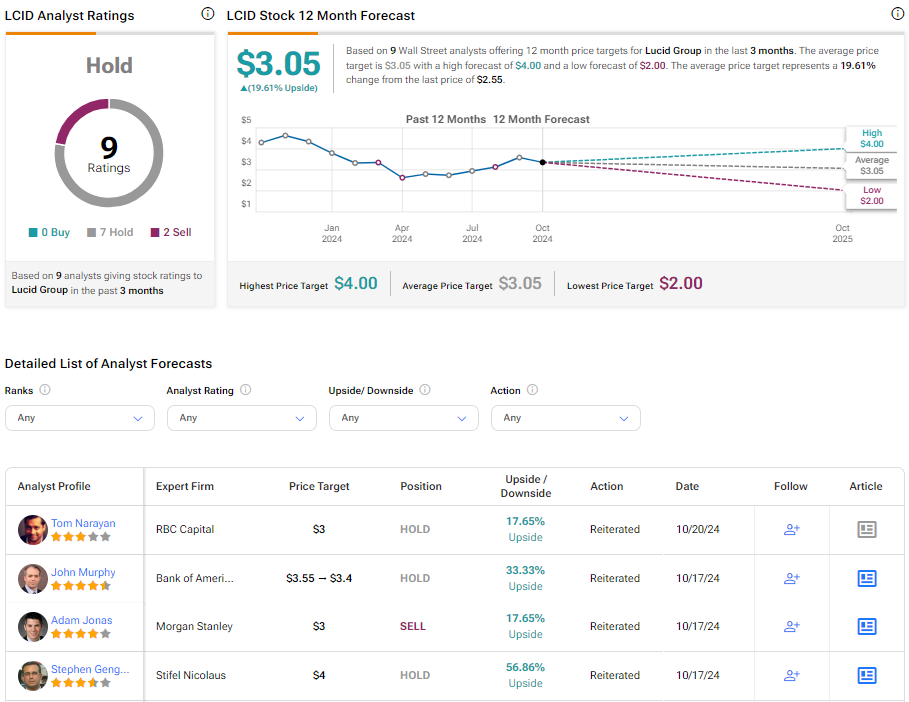

Analysts following the company have taken a cautious stance on LCID stock. Based on nine analysts’ recent recommendations, Lucid Group is rated a Hold overall. The average price target for LCID stock is $3.05, representing a potential upside of 19.61% from current levels.

Bottom Line on Lucid

Lucid is currently being tested by operational and financial constraints. The company’s recent share issuance has led to substantial dilution and has not resonated well with investors. This, coupled with less-than-impressive Q3 production and delivery results, paints a somewhat gloomy picture.

Despite the Saudi Arabian government’s financial backing, doubts persist about the company’s capacity to generate substantial revenues and profits in a fiercely competitive market. Lucid’s high valuation, which appears unjustified given its modest performance, raises further questions about its sustainability. With no clear growth catalysts, investors might want to approach LCID with extreme caution.