Shares of the Lovesac Company (NASDAQ: LOVE) gained 21% on March 29, after it delivered a blowout fourth-quarter results, significantly topping both earnings and revenue estimates.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The quarterly beat was driven by robust showroom sales and lower promotional discounting despite increased freight and warehousing costs and other macro headwinds.

Lovesac is an American furniture retailer, and specializes in a patented modular furniture system. It designs, manufactures, and sells furniture. These include modular couches called sactionals; foam beanbag chairs called sacs; as well as custom-fit covers, and associated accessories.

Q4 Outperformance

Markedly, adjusted earnings of $2.03 per share grew 48.2% year-over-year, and massively beat analysts’ expectations of $0.54 per share. The company reported earnings of $1.37 per share for the prior-year period.

Moreover, net sales jumped 51.3% year-over-year to $196.2 million, and exceeded consensus estimates of $174.33 million. The increase in revenues reflects a surge in comparable sales, which grew 50% during the quarter.

Notably, showroom comparable sales grew an impressive 72.6%, attributable to fully-reopened showrooms to the walk-in phase that remained operational throughout the fourth quarter. The growth was further aided by a strong holiday promotional campaign, coupled with lower discounting, and the addition of 28 new showrooms.

Despite its top-line beat, gross margin declined 200 basis points to 55.9% due to increased freight costs, tariff expenses, and warehousing costs, partially offset by lower promotional discounting.

CEO Comments

Sounding bullish on the company’s long-term growth prospects, Lovesac CEO, Shawn Nelson, commented, “We’ll drive this growth by remaining focused on key drivers: smart investments in product extensions and technology, creative deployment of our omni-channel sales model, supply chain and operating efficiencies.”

Wall Street’s Take

Following the upbeat Q4 results, Stifel Nicolaus analyst Lamont Williams reiterated a Buy rating on The Lovesac Company with a price target of $110 (93% upside potential).

The rest of the Wall Street community is cautiously optimistic about the stock, with a Moderate Buy consensus rating based on two Buys. The average Lovesac Company price target of $111.50 implies 95.65% upside potential to current levels.

Investors Weigh In

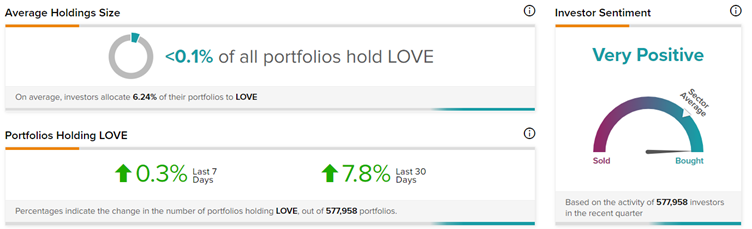

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on the Lovesac Company, with 7.8% of investors increasing their exposure to VER stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Jefferies Beats Q1 Expectations; Shares Gain 3.7%

Lightning eMotors Slips 11.8% on Revenues Miss & Dim Outlook

Science Applications Delivers Upbeat Q4 Results; Shares Gain 4.2%