The Nasdaq-100 index (NDX) is a tech-focused index that includes 100 of the largest non-financial companies listed on the Nasdaq Stock Exchange. It features major players like Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Nvidia (NVDA), and Alphabet (GOOGL), which together contribute a substantial share of its overall value. To invest in this growth-oriented index, investors can opt for ETFs like Invesco NASDAQ 100 Index ETF (TSE:QQC) or iShares NASDAQ 100 Index ETF Trust Unit (TSE:XQQU). These ETFs have delivered strong returns so far in 2024.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Let’s take a deeper look at these two ETFs.

Invesco NASDAQ 100 Index ETF

Founded in 2011, QQC is a Canadian ETF that tracks the Nasdaq-100 Index. Further, QQC is a currency-hedged ETF, that aims to reduce the impact of foreign exchange rate fluctuations on the fund’s performance.

The ETF has C$586.22 million in assets under management (AUM). Importantly, it has a low expense ratio of 0.2%. Moreover, the QQC ETF has returned 29.91% year-to-date.

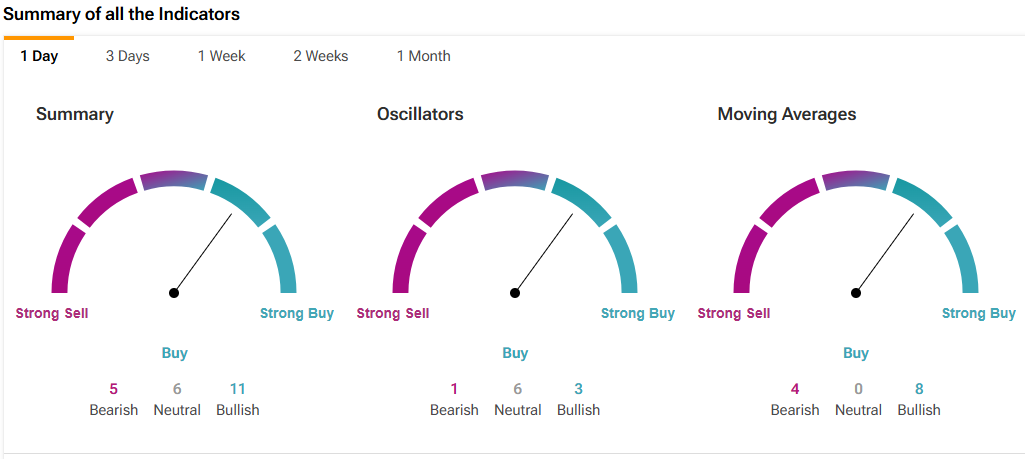

Overall, in the one-day time frame, the QQC ETF is a Buy, according to TipRanks’ technical analysis tool. This is based on 11 Bullish, six Neutral, and five Bearish signals.

iShares NASDAQ 100 Index ETF Trust Unit

XQQU is another Canadian ETF aimed at tracking the performance of the Nasdaq-100 Index. Managed by BlackRock Asset Management Canada Limited, it is designed for investors with a medium to high risk tolerance.

The ETF has C$83.42 million in AUM and an expense ratio of 0.39%. So far in 2024, XQQU ETF has generated a return of 30.1%.

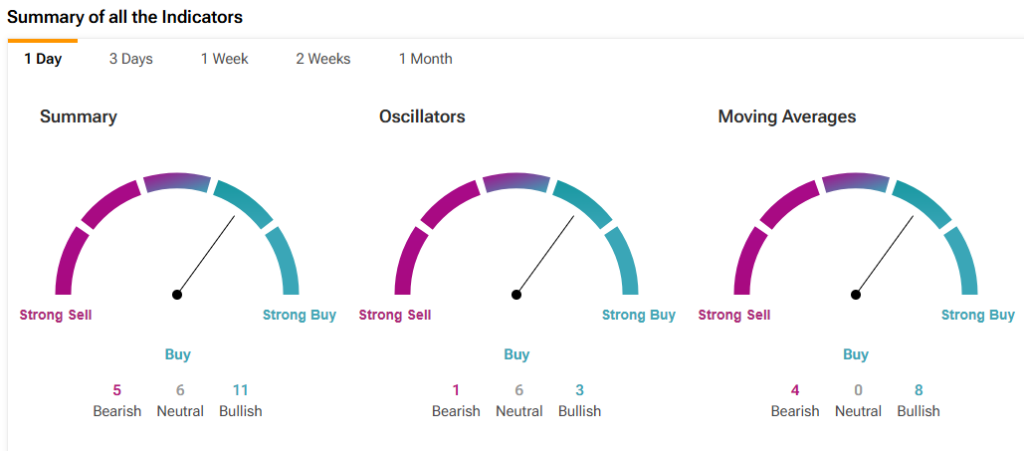

According to TipRanks’ technical analysis tool, XQQU ETF is a Buy. This is based on 11 Bullish, six Neutral, and five Bearish signals.

Concluding Thoughts

ETFs are a low-cost, liquid, and transparent way to participate in the market. Investors seeking exposure to the top technology stocks might consider ETFs like QQC and XQQU, which have received a Buy rating from TipRanks’ technical analysis tool.