Palantir (NYSE:PLTR) seems poised for a promising future, with its AI technology playing a growing role in the decision-making processes of both corporations and governments.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company has posted profits for seven consecutive quarters, and its Q2 2024 results once again showcased impressive growth. Palantir’s boot camp approach has provided potential clients with hands-on experience, leading to a significant rise in paying customers – up 83% year-over-year and 13% quarter-over-quarter in Q2 2024 alone.

Based on these positive numbers, the stock has been rocketing skywards, gaining 112% in 2024.

However, one top-rated investor, known as Cavenagh Research, acknowledges Palantir’s success but believes the stock has climbed too high to justify adding to a position at this time.

“Palantir’s current stock price reflects a significant overvaluation, making it difficult to justify an investment at these levels,” writes Cavenagh, who sits in the top 4% of all TipRanks’ stock pros.

According to Cavenagh, using the projected $1.2 billion in operating profits for 2026 puts Palantir at an EV/EBIT ratio of nearly 60, representing a 300% premium compared to its peers in the IT sector.

Other metrics also suggest overvaluation. Cavenagh highlights that Palantir’s P/E ratio, Price-to-Sales ratio, and EV/EBITDA ratio are 382%, 1,000%, and 1,193% higher than the sector averages, respectively.

“Needless to say, all these figures reflect extreme overvaluation compared to its peers, making it (for me) impossible to argue for an investment based on current valuation levels,” Cavenagh opined.

All that being said, the investor understands the allure of PLTR, citing its success in enlisting commercial customers and aligning itself with a number of U.S. defense priorities. In addition, the company’s recent inclusion in the S&P 500 will cause an “increased demand for its shares from index funds and ETFs that track the index, leading to immediate buying pressure and potentially higher stock prices.”

However, at the end of the day, the high share price makes it hard “to justify an investment at these levels.”

“Accordingly,” Cavenagh summed up, “I remain ‘Sell’ rated until the risk reward improves. (To watch Cavenagh Research’s track record, click here)

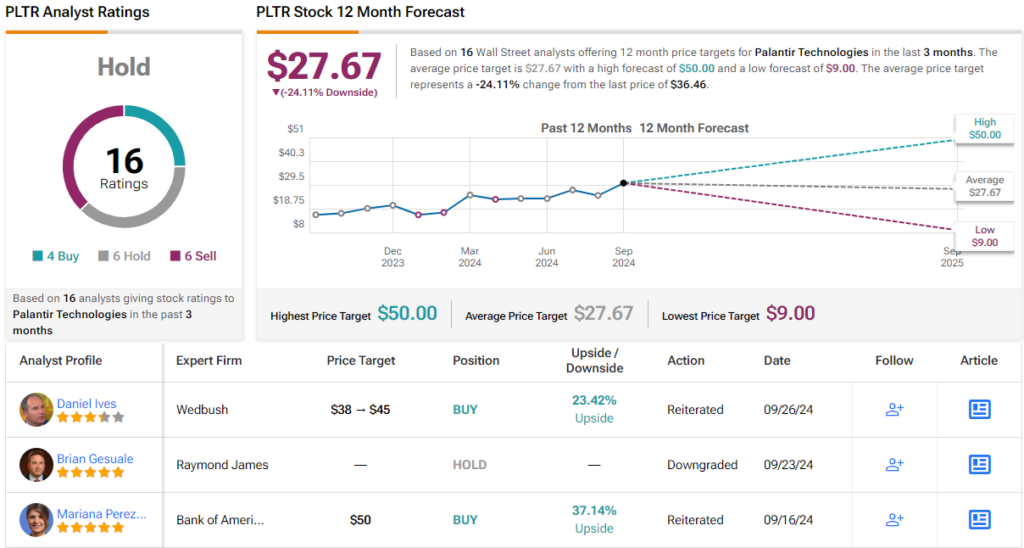

The view seems to be a bit pessimistic among Wall Street analysts as well. With 4 Buy, 6 Hold, and 6 Sell ratings, PLTR carries a consensus rating of Hold (i.e. Neutral). Its 12-month average price target of $27.67 implies a potential downside of 24% from current levels. (See PLTR stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.