Over the past two years, Nvidia (NASDAQ:NVDA) has succeeded in capturing the AI lighting in a bottle. It has soared into the stratosphere and become one of the largest, most influential businesses in the world.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The AI chipmaker now dominates the data center market, with its graphics processing units (GPUs) becoming essential for the world’s leading mega-tech companies.

As a result, investors have been handsomely rewarded, with shares skyrocketing 166% this year, reflecting the company’s remarkable growth.

However, while past performance is encouraging, investing is inherently about the future. This begs the question: how much longer can Nvidia sustain its white-hot growth streak?

One top investor, known by the pseudonym The Asian Investor, believes that lightning will strike again for Nvidia, driven by the release of its cutting-edge Blackwell GPUs. Despite a slight delay, these chips are expected to ship in large volumes early next year.

“The market currently massively underestimates Nvidia’s incremental revenue upside related to the launch of its Blackwell chips,” writes the 5-star investor, who sits in the top 2% of TipRanks’ stock pros.

Asian Investor sees a few trends coalescing to support this bullish stance. For one, the investor notes that Nvidia is already experiencing “insane demand” for Blackwell from hyperscalers, as the chips offer “massive inference performance gains compared to the prior-gen model.”

Additionally, supply for these data center GPUs could soon tighten, creating even more opportunities for Nvidia to boost its margins. With the AI data center market projected to reach $500 billion by FY 2028, Nvidia stands to benefit from significant tailwinds, according to the investor.

This could lead to “a massive revenue upswing” that the market has yet to fully price in, reminiscent of Nvidia’s position in early 2023.

“My conservative estimate suggests Nvidia could generate $80-120B in incremental revenue from Blackwell in FY 2025, significantly higher than consensus forecasts,” writes Asian Investor.

The investor warns that missing out on Nvidia now would be a mistake, just as it was at the start of 2023. “The GPU shipment ramp is just getting started,” concludes Asian Investor, who rates NVDA a Strong Buy. (To watch The Asian Investor’s track record, click here)

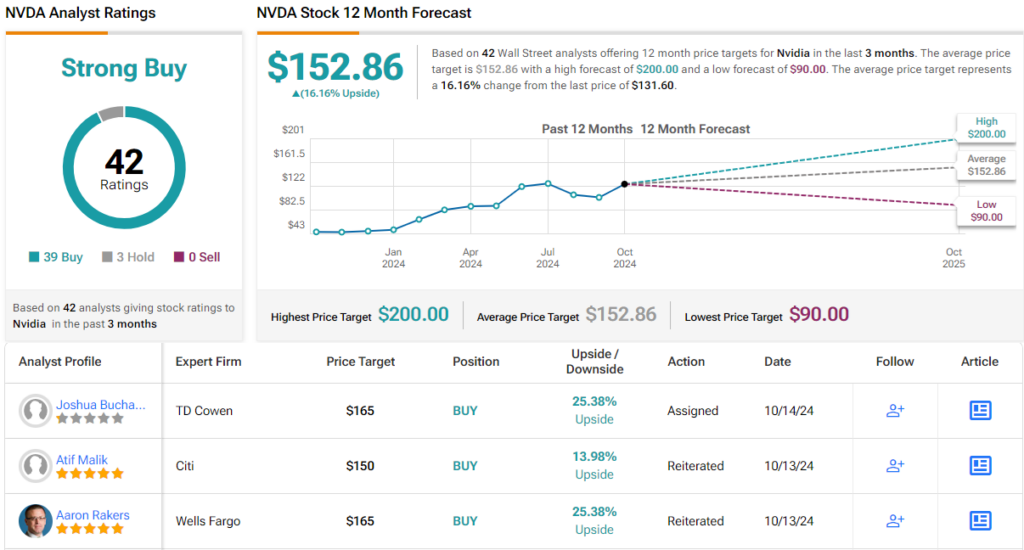

This is consistent with the overall sentiment on Wall Street. With 39 Buy ratings and only 3 Holds, NVDA enjoys a Strong Buy consensus. Its 12-month average price target of $152.86 suggests a potential 16% gain in the year ahead. (See NVDA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.