Wall Street analysts are buzzing about tech as usual, but this week, their attention is drawn to a couple of key upcoming events. As a result, they’re advising investors to keep an eye on Tesla (NASDAQ:TSLA) and Advanced Micro Devices (NASDAQ:AMD).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Both firms are go-to companies for tech investors. Tesla is known for its hands-on approach to EVs, but Elon Musk’s flagship company is also knee-deep in AI, robotics, and a combination of the two, autonomous vehicles. AMD, a well-entrenched name in the semiconductor chip industry, has made a name for itself among AI stocks and is gearing up new products with the potential to expand its market share in the competitive AI chip sector.

We’ll see on Thursday, when both companies have scheduled ‘product reveal’ events, whether they’ll measure up to the hype. In the meantime, several analysts are giving these stocks Buy recommendations ahead of the events. Let’s take a closer look.

Tesla

We’ll start with Tesla, a company that was founded as a start-up back in 2003 and today has become the world leader in the electric car niche. The company is a pure-play EV maker, and its $780 billion market cap makes it the world’s largest car company of any type, with more than triple the valuation of second-place Toyota.

Tesla’s success has come on the shoulders of its core EV business. The company has several EV models in production, although the lowest-price variant of its popular Model 3 has recently been discontinued in the US market. Tesla’s other vehicles include the Model Y, Model X, Model S, and the Cybertruck. Vehicle sales on these models make up the lion’s share of Tesla’s revenues – so it may be important that the Q3 delivery report came in below consensus.

The Q3 numbers showed a total of 469,796 vehicles produced in the quarter, with 462,890 deliveries. The Models 3 and Y continued to be Tesla’s most popular vehicles, accounting for 439,975 deliveries in Q3, while the other models accounted for 22,915. These numbers were below the 435,902 and 26,315 consensus figures. We should note that Tesla’s deliveries are down in recent months; in Q2 of this year, the company delivered 443,956 vehicles, and its delivery record was 484,507 in 4Q23.

But Tesla may get a boost this week, when the company holds its ‘We, Robot’ event on Thursday evening in Burbank, California. Musk started the hype back in April, with his teaser of a new Robotaxi. He set an August 8 reveal at that time, which was pushed back; this week’s event is considered something of a ‘show me’ for Musk. He’s been talking about autonomous vehicles for several years, and has described his push for the Robotaxi as ‘balls to the wall’ in autonomous vehicle tech. A convincing reveal may goose investor interest in the company.

Wedbush analyst Daniel Ives is already setting the stage, noting: “We believe this is a pivotal time for Tesla as the company prepares to release its years of Robotaxi R&D shadowed behind the curtains, while Musk & Co. lay out the company’s vision for the future. We remain confident in the Tesla story which has proven successful many times over the years, and we look forward to this long-awaited event as the next evolution of transportation unfolds… We continue to believe Tesla is the most undervalued AI name in the market and we expect Musk & Co. to unveil some ‘game changing’ autonomous technology at this event…”

For Ives, Tesla earns an Outperform (i.e. Buy) rating, with a $300 price target that suggests the stock will gain more than 23% in the next 12 months. (To watch Ives’ track record, click here)

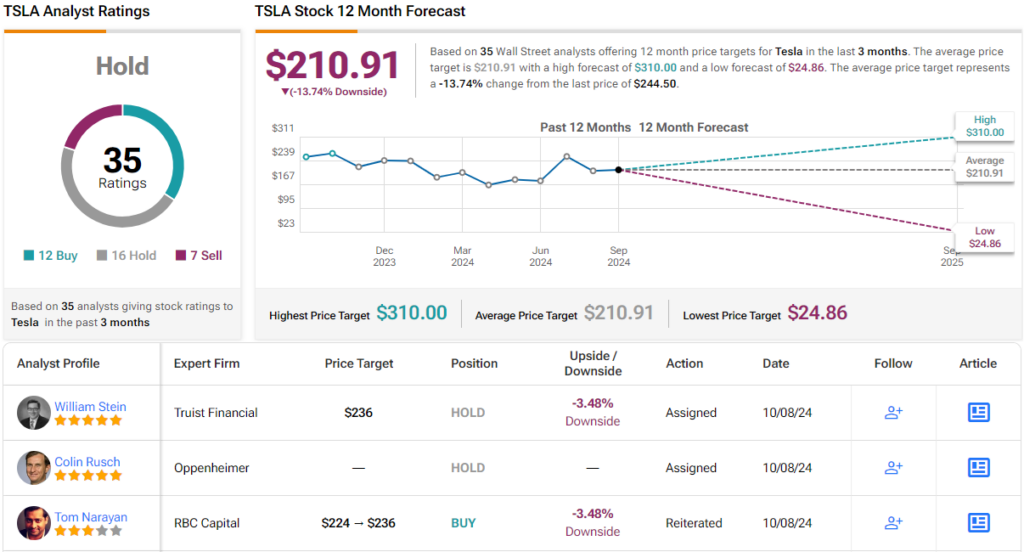

While Ives is bullish, the Street as a whole is showing caution. TSLA shares have a Hold (i.e. Neutral) consensus rating, based on 35 reviews that include 12 Buys, 16 Holds, and 7 Sells. The stock is trading for $244.50 and its $210.91 average target price implies a drop of more than 12% lying in store for the year ahead. (See Tesla stock forecast)

Advanced Micro Devices (AMD)

Next up is AMD, a major force in the semiconductor industry with a market cap of $280 billion, making it the sixth-largest chipmaker worldwide. While AMD still trails behind the more attention-grabbing Nvidia, it appears the company is making strides to boost its market share. On Thursday, we’ll gain insight into this strategy when AMD unveils its new product line.

AMD is poised to reveal several new lines, including the Instinct GPU accelerators and the EPYC server processors, as well as potentially a follow-on to the MI300 accelerator series launched at the end of last year. The new products are designed as a direct challenge to Nvidia, and although AMD is not likely to unseat the multi-trillion market leader, it can increase its own market share – to the benefit of its investors.

It helps that AMD’s MI300 series has already proven both successful and popular, and that it is currently in use by a number of high-profile customers. Major companies such as Meta, Microsoft, and Oracle are said to be using AMD’s current products. A solid set of new products, combined with a strong base of leading AI customers, can cement AMD’s niche in the AI chip market.

Even now, ahead of the reveal event, AMD’s Q3 earnings are expected to show gains over Q2. The company is expected to release 3Q24 results later this month, and analysts are predicting approximately $6.7 billion in revenue and 91 cents in EPS. If achieved, these figures will mark solid gains from the Q2 results of $5.84 billion at the top line and 69 cents per share at the bottom.

For Cantor Fitzgerald’s CJ Muse, a 5-star analyst rated in the top 2% of the Street’s stock pros, the AI release event is the key.

“During last year’s Advancing AI event (December 2023), AMD introduced its Instinct MI300 series GPU/APU platform, discussed AI PCs and advances with its ROCm software stack, and outlined its $400B+ AI TAM for 2027 (up from $150B+). We expect this year’s event to have similar product announcements, with AMD officially launching products for data center CPU (Turin), data center accelerators (MI325X), and AI PCs (likely Strix PRO). Additionally, we expect the company to discuss advancements in its ROCm software ecosystem, progress with its strategy to provide greater value through system level solutions (see recent ZT Systems acquisition), and potentially provide an update to the company’s AI TAM (perhaps towards the 2028-2030 time frame),” the analyst opined.

Looking ahead, Muse lays out an upbeat picture for investors, stating, “Confidence in securing Inference design wins at an increasing breadth of customers beyond key customers will likely be the main focus (with rumored AMZN and/or GOOGL presenting as a good start). If management can do a good job here, AMD shares should outperform into the day and likely for the remainder of 4Q24E and into 2025E.”

Muse goes on to put an Overweight (i.e. Buy) rating on AMD stock, although his price target of $180 implies a relatively modest one-year upside potential of 4%. It will be interesting to see whether the analyst updates his target after the event. (To watch Muse’s track record, click here)

Overall, the bulls are running for AMD, which has a Strong Buy from the analyst consensus. That rating is derived from 31 analyst reviews breaking down 25 to 6 favoring Buys over Holds. The stock’s $188.04 average target price implies a one-year gain of nearly 9%. (See AMD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.