Levi Strauss (NYSE:LEVI) declined in pre-market trading after the clothing company’s revenues in the fiscal second quarter of $1.44 billion increased 7.5% year-over-year but fell short of Street estimates of $1.45 billion. However, the company’s denim continues to surge in popularity.

LEVI’s CEO Remains Bullish on Denim

Levi Strauss CEO Michelle Gass told CNBC’s Jim Cramer that while the company’s denim skirts and denim dresses have not historically been big businesses, “they’re exploding, up triple digits in the quarter.” Furthermore, Gass noted a trend towards more baggy and loose clothes.

Additionally, the CEO noted that LEVI’s success in the second quarter was driven by direct-to-consumer (DTC) sales and the women’s category, with robust sales in the U.S., its biggest market. Gass stated that the company has moved past the supply chain issues it faced last year and expects accelerated momentum in the second half of the year.

Indeed, the company’s direct-to-consumer sales increased by 8.2% year-over-year to $672.5 million in the second quarter and comprised more than 40% of its total sales.

UBS Analyst Remains Upbeat About LEVI

While LEVI’s Q2 results did not seem to cheer investors, UBS five-star rated analyst Jay Sole remained upbeat about the stock, maintaining a Buy rating and a price target of $25. The analyst’s price target implies an upside potential of 8.1% at current levels.

Sole believes that the market is underestimating LEVI’s brand strength and DTC investments. Despite challenges in distribution, marketing speed, and foreign currency fluctuations, the analyst’s thesis on “their potential remains intact.”

As a result, the analyst expects LEVI’s solid execution to drive its earnings per share (EPS) to grow at a compounded annual growth rate (CAGR) of 16% over five years.

Is LEVI Stock a Good Buy?

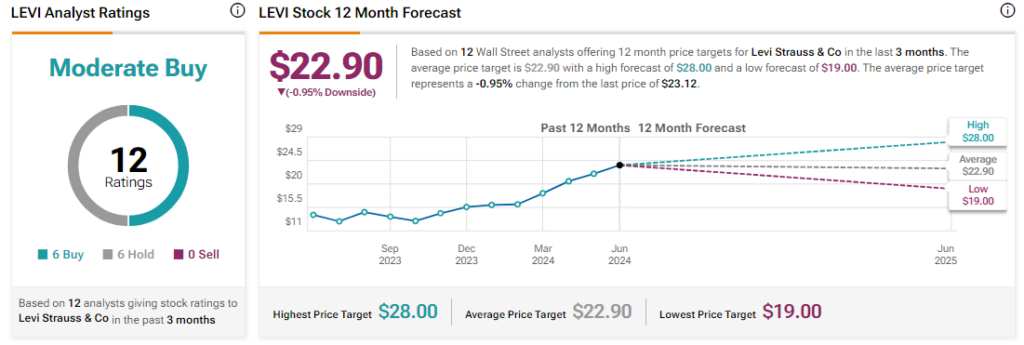

Turning to Wall Street, analysts are cautiously optimistic with a Moderate Buy consensus rating on LEVI stock based on six Buys and six Holds assigned in the past three months. After a 63% rally in its share price over the past year, the average LEVI price target of $22.90 per share implies that shares are fairly valued at current levels.