Insurance tech company Lemonade (NYSE: LMND) announced better-than-anticipated first-quarter results but lagged expectations for Q2 and full-year revenue outlook. The company announced its results after market hours on May 9. Shares were volatile in the pre-market trading hours on Tuesday, May 10.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Powered by artificial intelligence and behavioral economics, Lemonade offers renters, homeowners, car, pet, and life insurance. Founded by Israeli entrepreneurs Shai Wininger and Daniel Schreiber, the company is headquartered in New York.

Lemonade shares have declined 56% so far this year due to the negative investor sentiment for growth stocks amid high inflation and soaring interest rates.

Key Q1 Metrics

Lemonade’s revenue grew 89% year-over-year to $44.3 million driven by a 71% rise in gross earned premium due to higher in-force premium and increase in ceding commission income from reinsurers.

In-force Premium (reflects aggregate annualized premium) grew 66% to $419 million fueled by a 37% rise in the number of customers to 1.5 million, and a 22% increase in premium per customer to $279.

Despite higher revenue, Lemonade’s net loss increased to $1.21 in Q1’22 from $0.81 in Q1’21 due to higher advertising and employee-related expenses to support continued expansion. However, Q1 revenue and loss per share were better than the Street’s estimates of $43.3 million and $1.44, respectively.

Outlook

Lemonade expects revenue of $46 million to $48 million in Q2, which fell short of analysts’ estimate of $51.4 million. The company predicts Q2 adjusted EBITDA loss in the range of $65 million to $70 million.

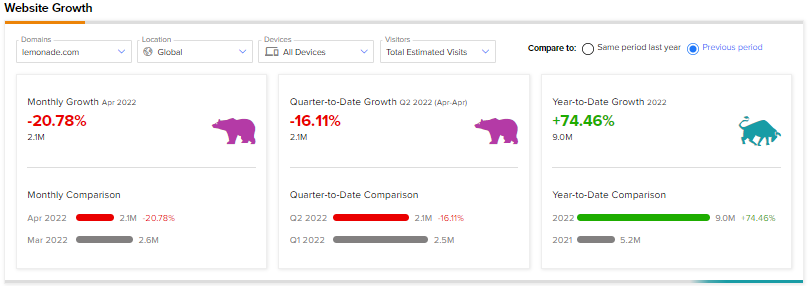

TipRanks’ Website Traffic tool indicates that total estimated visits on the Lemonade website declined 20.78% in April compared to those in March. Also quarter-to-date website traffic in Q2’22 has declined 16.11% on a sequential basis.

Meanwhile, Lemonade expects full-year revenue in the range of $205 million to $208 million and adjusted EBITDA loss between $265 million to $280 million. Analysts were expecting revenue of $217 million.

Wall Street’s Take

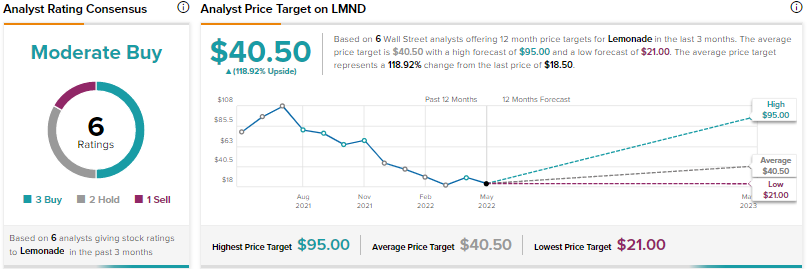

Following the print, Bank of America Securities analyst Joshua Shanker lowered the price target on Lemonade to $19 from $21 and retained a Sell rating.

Overall, the Street is cautiously optimistic on Lemonade stock, with a Moderate Buy consensus rating based on three Buys, two Holds and one Sell. The average Lemonade price target of $40.50 implies 118.92% upside potential from early Tuesday trading levels.

Closing Thoughts

While Lemonade’s revenue has been growing at a strong rate, investors have been concerned about the mounting losses as the company continues to invest in its expansion.

Investors were also concerned about the company’s high loss ratio, but in Q1’22 the net loss ratio improved to 89% from 120% from the prior-year quarter.

Lemonade is optimistic about its expectation of a multi-year average loss ratio within a target of 75%. Perhaps, that should be a bit reassuring for its investors, though concerns about the company’s revenue outlook could be a drag in the near-term.

Discover new investment ideas with data you can trust

Read full Disclaimer & Disclosure