The Gap (GAP) rolled out its earnings report today, though, as it turned out, the release was a bit unexpected. In fact, it was sufficiently unexpected to shut down trading for a while. But now, Gap shares are up over 2.5% in Thursday afternoon’s trading on the strength of that leaked report.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The Gap was expected to present its earnings report after the closing bell today, but the report unexpectedly slipped out ahead of time as it inadvertently hit the company’s website earlier today. The report was taken down, but in the meantime, trading was halted in Gap stock as everyone suddenly had insider knowledge. The fallout, though, was not particularly onerous, as shares slipped around 1% in the meantime.

The Gap, for its part, didn’t respond to requests for comment. But this quarter is special for The Gap, as this is part of what should be The Gap’s turnaround story. It showed positive signs back in the first quarter, and investors are watching closely now to see if that was a fluke or the start of something great.

A Hesitant Consumer

Retailers of all stripes are facing a common problem these days: the hesitant consumer. Battered by skyrocketing inflation with little sign that prices will ever get “back to normal,” they are beginning to reconsider their purchases. And one report from Business Insider suggests that may be a bigger problem for The Gap than some may expect.

When the Business Insider report took a trip to several clothing stores in search of a new polo shirt, the discovery was that higher-priced options like The Gap were simply not “worth the splurge.” A comparative bargain from Old Navy proved the better option, a point which should prove worrying to a clothing company that is supposed to be in its turnaround arc.

Is The Gap a Good Stock to Buy?

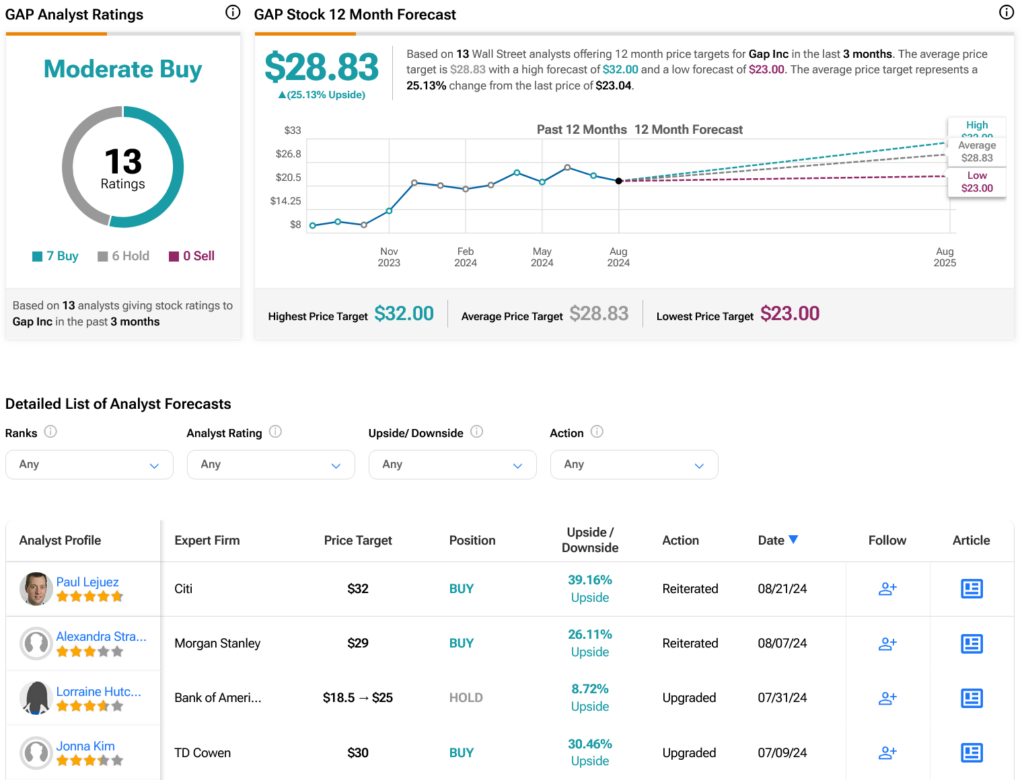

Turning to Wall Street, analysts have a Moderate Buy consensus rating on GAP stock based on seven Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 109.77% rally in its share price over the past year, the average GAP price target of $28.83 per share implies 25.13% upside potential.