Chip company Lattice Semiconductor (NASDAQ: LSCC) slid in pre-market trading after announcing weak fourth-quarter results. The company posted revenues of $170.6 million, a decline of 3% year-over-year. This fell short of consensus estimates of $174.1 million.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Lattice reported Q4 adjusted earnings of $0.45 per share compared to earnings of $0.49 per share in the same period last year. Still, this was above Street estimates of $0.43 per share.

Looking ahead to the first quarter, the company expects revenues between $130 million and $150 million, below consensus estimates of $174.4 million. LSCC has also forecasted its Q1 adjusted gross margin to be 69% (plus or minus 1%).

Is LSCC a Good Stock to Buy?

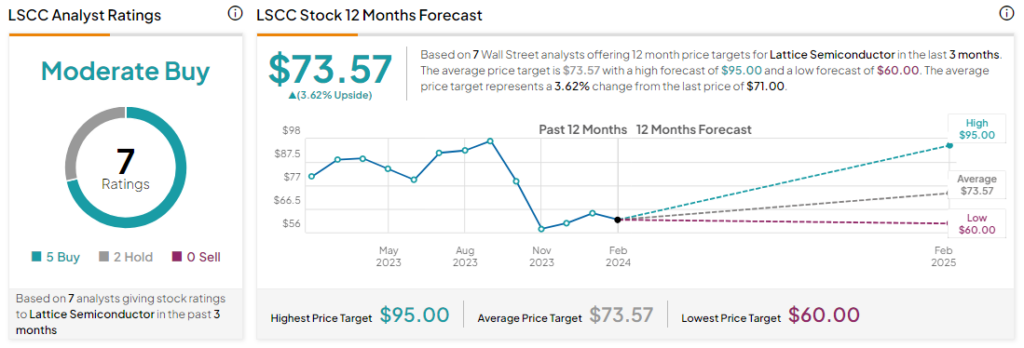

Analysts remain cautiously optimistic about LSCC stock with a Moderate Buy consensus rating based on five Buys and two Holds. Over the past year, LSCC has slid by more than 10%, and the average LSCC price target of $73.57 implies an upside potential of 3.6% at current levels.