Alphabet (NASDAQ:GOOGL) kicks off the Big Tech brigade this week, as earnings reports roll in from the top of the market food chain. As the world’s 4th most valuable company, Alphabet is firmly positioned among these giants.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

That said, recent times have not been obstacle-free for the search giant. In the crosshairs of the lawmakers on accusations of monopolistic practices and at risk of losing search share to genAI competitors, the stock has been under pressure lately.

With the company due to report Q3 earnings today after the close (Tuesday), this is a point picked up by Evercore’s Mark Mahaney, an analyst ranked amongst the top 1% of Street stock experts. “With GOOGL, we see a stock that has underperformed intra-quarter, with relatively modest Street expectations for Q3 Search (11% Y/Y), YouTube (12%), and Cloud (no Y/Y acceleration) revenue, as well as overall Operating Margins (down 190 bps Q/Q),” the 5-star analyst noted.

As Mahaney’s Ad channel checks suggest a “continued healthy overall Ad spend environment in Q3,” the analyst thinks the Street’s Q3 forecasts for Gross Revenue (up 12.7% year-over-year, representing a 1-point slowdown on a “4-point tougher comp”) and Advertising Revenue (a 10% YoY increase, amounting to a 1-point slowdown on a 6-point tougher comp) are “fairly reasonable.” Mahaney is calling for revenue of $85.9 billion, just under the Street’s expectation for $86.4 billion.

Additionally, Mahaney’s checks show steady to slightly slowing growth in Search revenue, while YouTube likely benefited from ad spending tied to the Paris Olympics and political campaigns.

The Street’s Cloud Revenue forecast (up 29% YoY) also seems reasonable and so does the Q3 Operating Margin estimate of 30.6%, given management’s focus on “FY margin expansion and the generally stable environment for Ad and Cloud industry pricing.”

So, “reasonable” appears to be the key word here, although one thing that looks more than reasonable to Mahaney is the stock’s current valuation. “The stock at 19X P/E remains close to a trough multiple,” says the analyst, “implying the potential for near-term upside on positive estimates revisions, even with the long-term overhang associated with the DOJ trials.”

All told, Mahaney maintained an Outperform (i.e., Buy) rating on the shares along with a $200 price target, implying the stock will gain 20% over the coming months. (To watch Mahaney’s track record, click here)

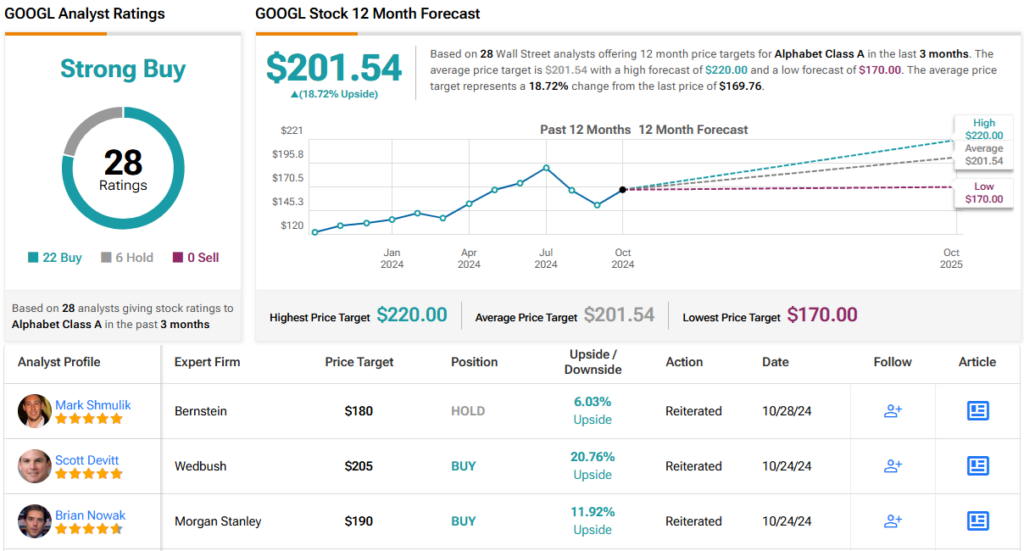

The Street’s average target is only slightly higher, and at $201.54, factors in a one-year return of 22%. The analyst consensus views this stock as a Strong Buy, a rating based on 22 Buys and 6 Holds. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.