Specialty chemicals products provider Chase Corp. (NYSE:CCF) has agreed to be acquired by investment funds affiliated with investment giant KKR & Co. (NYSE:KKR) in an all-cash $1.3 billion deal.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The deal also includes the assumption of debt and points to a 13x implied valuation of CCF’s trailing twelve months EBITDA. Further, KKR will snap up all outstanding shares of CCF at $127.50 apiece. After a nearly 40% gain over the past year, CCF shares are down nearly 1.1% at the time of writing today.

CCF is a leading name in highly-engineered protective materials and the strategic deal with KKR is anticipated to help the company in new product development, undertaking strategic acquisitions, and catering to high growth end-markets.

The acquisition has received the approval of CCF’s Board and is expected to close in the fourth quarter of this year. Upon closing, CCF will transition into private ownership as an affiliate of KKR’s investment funds.

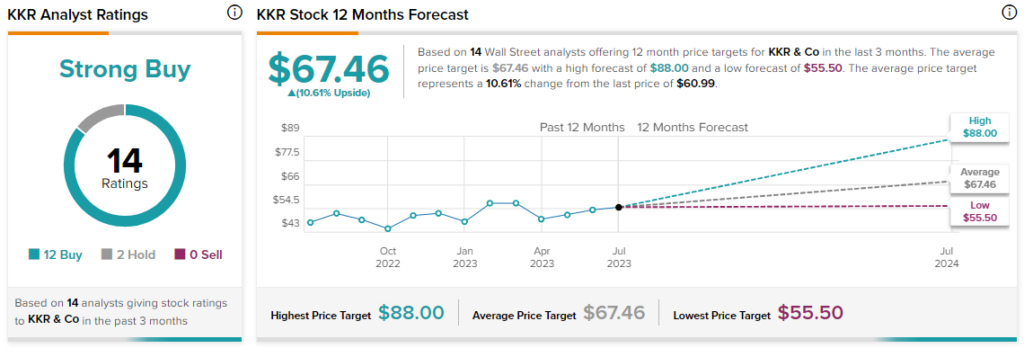

Overall, the Street has a $67.46 consensus price target on KKR alongside a Strong Buy consensus rating. Shares of the company have gained nearly 30.7% year-to-date.

Read full Disclosure