Karoon Energy (ASX:KAR) shares rose by as much as 12% today, after the company announced that the Brazilian government has agreed to reduce its royalty rate in the Baúna project.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

Melbourne-headquartered Karoon is an oil and gas exploration and production company. It has operations in Australia and Brazil. Karoon secured the royalty reduction deal in Brazil after making additional investments in the Baúna project to increase production.

Rising alongside Karoon stock were Whitehaven Coal Limited (ASX:WHC), Imugene Limited (ASX:IMU), and Viva Energy Group Ltd. (ASX:VEA) shares. ASX energy shares have rallied in recent days after the OPEC+ group agreed to a major oil production cut.

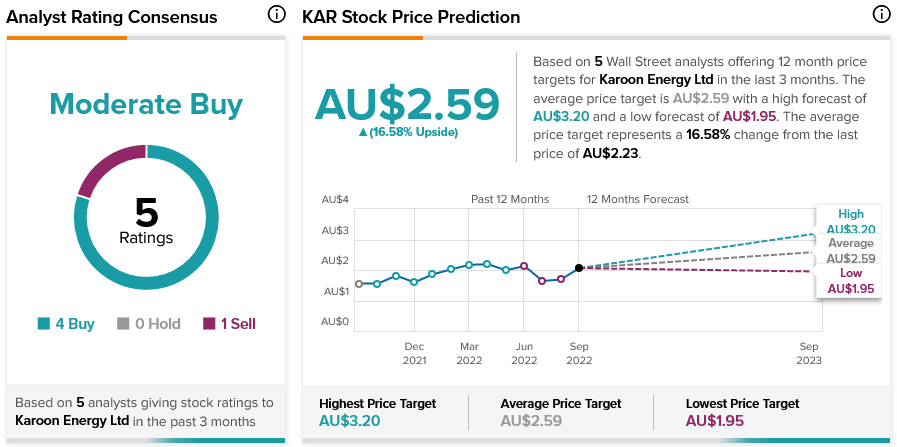

Karoon share price forecast

Karoon shares have climbed more than 40% in the past three months. According to TipRanks’ analyst rating consensus, Karoon stock is a Moderate Buy based on four Buys and one Sell. The average Karoon share price forecast of AU$2.59 indicates over 16% upside potential.

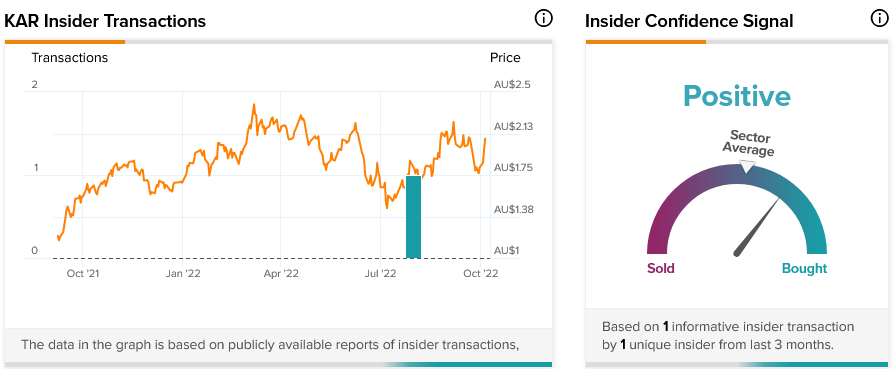

Karoon stock is a favourite of company insiders, such as directors and executives. TipRanks’ Insider Trading Activity shows that Insider Confidence Signal is currently Positive on Karoon. Corporate insiders purchased AU$32,600 in Karoon shares in the past three months.

Closing thoughts

Brazil’s royalty rate cut in the Baúna project should allow Karoon to pocket more money from the operation, which bodes well for the company’s overall future earnings.