Shares of transportation holding firm Kansas City Southern (KSU) closed 1.1% lower at $266.33 on Friday after it reported lower-than-expected financial results for the second quarter.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company has investments in railroads in Panama, Mexico and the U.S. Its rail network includes approximately 6,700 miles of tracks spread across Mexico and the U.S.

Revenues increased 37% year-over-year to $749.5 million but missed the Street’s estimates of $751 million. The rise was driven by higher fuel surcharge, higher volumes, and a stronger Mexican peso.

Adjusted earnings per share (EPS) stood at $2.06, up from $1.15 reported in the second quarter of 2020, and missed analysts’ expectations of $2.19. (See Kansas City stock chart on TipRanks)

The President and CEO of Kansas City, Patrick J. Ottensmeyer, said, “Our operating team is focused on implementing structural and sustainable changes that will improve operational performance and the resiliency of our network. To that end, we have deployed additional assets and crews in support of our service recovery, setting the company up to continue delivering robust volume growth while improving customer service in the second half of 2021.”

Last month, Citigroup analyst Christian Wetherbee downgraded the stock from Buy to Hold but raised the price target from $275 to $305 (14.5% upside potential). The analyst cited the pending takeover premium as the reason for the downgrade.

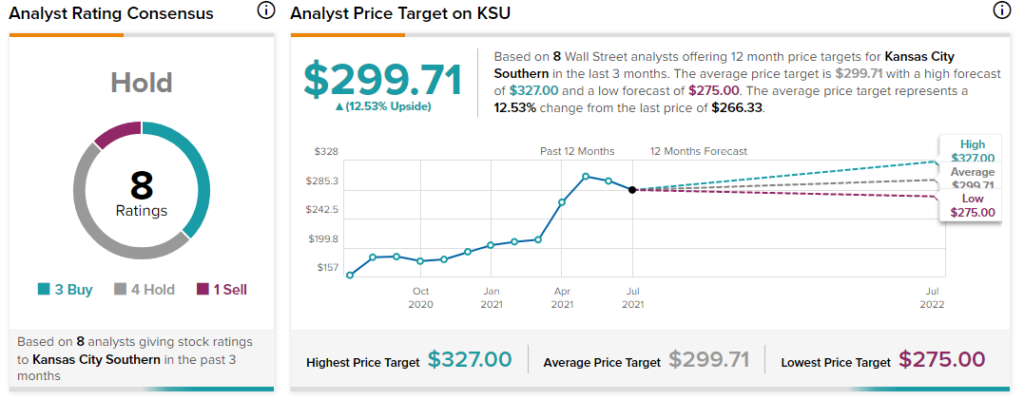

Overall, the stock has a Hold consensus based on 3 Buys, 4 Holds and 1 Sell. The average Kansas City Southern price target of $299.71 implies 12.5% upside potential. Shares have gained 70.7% over the past year.

Related News:

Moderna to Replace Alexion in S&P 500

Taiwan Semiconductor Misses Earnings Estimates, Shares Fall

Walmart Launches Justice Brand’s Comeback