Shares of Nordstrom (NYSE:JWN) fell in after-hours trading after the retailer reported earnings for its first quarter of Fiscal Year 2024. Earnings per share came in at -$0.24, which missed analysts’ consensus estimate of -$0.07 per share. However, sales increased by 5.2% year-over-year, with revenue hitting $3.22 billion. This beat analysts’ expectations by $20 million.

TipRanks Cyber Monday Sale

- Claim 60% off TipRanks Premium for data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

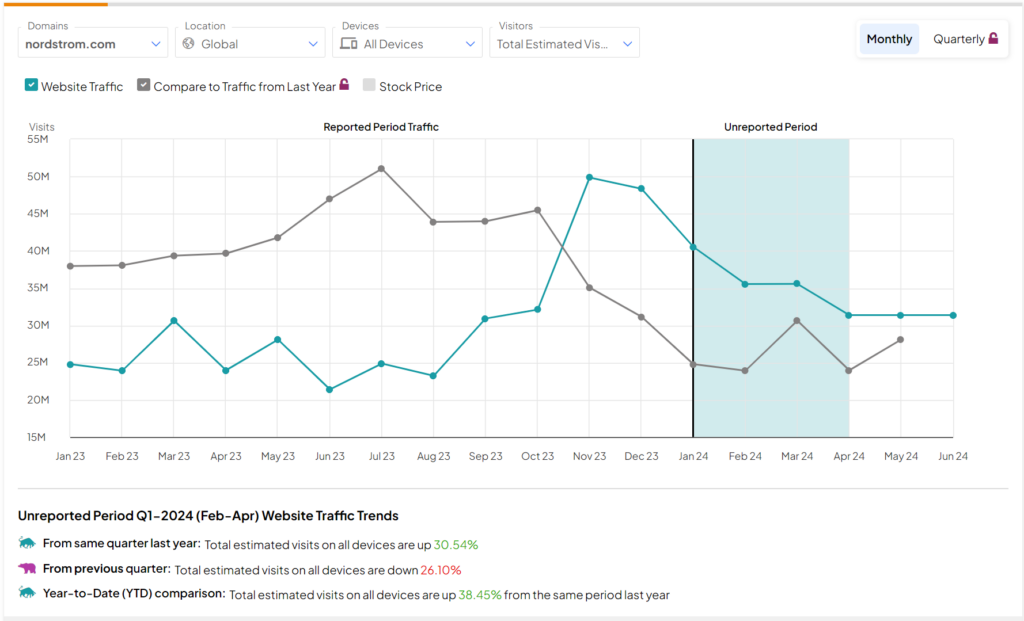

The year-over-year growth in revenue makes sense when looking at Nordstrom’s website traffic. As the image below shows, the number of visitors rose significantly during the most recent quarter. In fact, total estimated visits jumped over 30% when compared to the same quarter of last year.

Looking forward, management now expects revenue growth and adjusted earnings per share for Fiscal Year 2024 to be in the ranges of -2% to 1% and $1.65 to $2.05, respectively. For reference, analysts were expecting -0.2% in revenue growth along with an adjusted EPS of $1.78.

Is Nordstrom Stock a Buy?

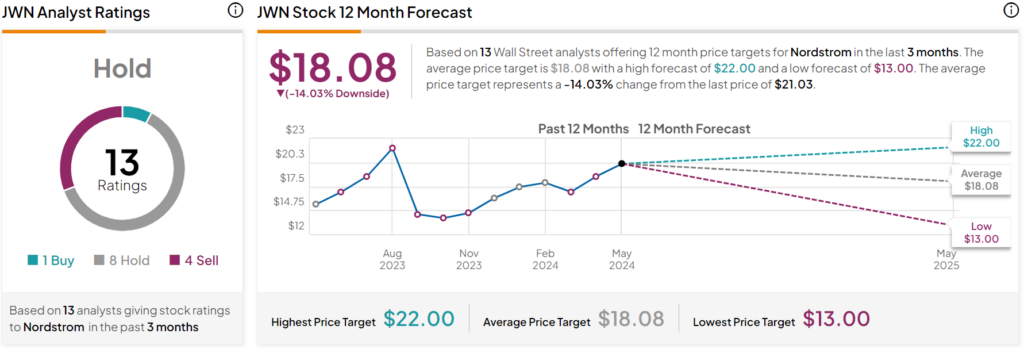

Turning to Wall Street, analysts have a Hold consensus rating on JWN stock based on one Buy, eight Holds, and four Sells assigned in the past three months, as indicated by the graphic below. After a 42% rally in its share price over the past year, the average JWN price target of $18.08 per share implies 14.03% downside potential.