Another round of cost-cutting is about to kick in, and this time at Unilever (NYSE:UL), a leader in the consumer goods space for things like soap and shampoo, among other things. This round of job cuts will be very targeted, though, so unless you’re in Europe, you have little to worry about. At least right now. That was good enough for investors, though, who sent shares up nearly 1.5% in Friday afternoon’s trading.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Unilever is set to fire one in three office workers as part of a plan to push growth. Unilever has been looking to streamline its operations for some time now, but this move will be taking a chainsaw to the Gordian knot.

Unilever’s recent underperformance prompted the latest round of cuts, with around 3,200 total roles set to hit the chopping block. The cuts are already starting and should be completed by the end of the year. They’re actually the biggest cuts that Unilever has seen in decades, based on an assessment by the current head of the European Works Council at Unilever, Hermann Soggeberg.

Advertising Collusion?

Meanwhile, Unilever is facing some new troubles, as its ad mix seems to be drawing fire from U.S. regulators. The House Judiciary Committee recently took GARM—the Global Alliance for Responsible Media, which includes major advertisers like Unilever—to task over ad-buying practices that seem to give short shrift to “right-wing” media like X, formerly Twitter.

Such a move might not ordinarily matter, but the House committee is looking into whether these ad-buying practices are a violation of the Sherman Antitrust Act. The committee, chaired by Republican Representative Jim Jordan of Ohio, asserts that the Alliance is using its massive ad spend to “silence conservative speech and platforms” by giving them little access to advertising dollars that they need to survive.

Is Unilever a Buy, Hold, or Sell?

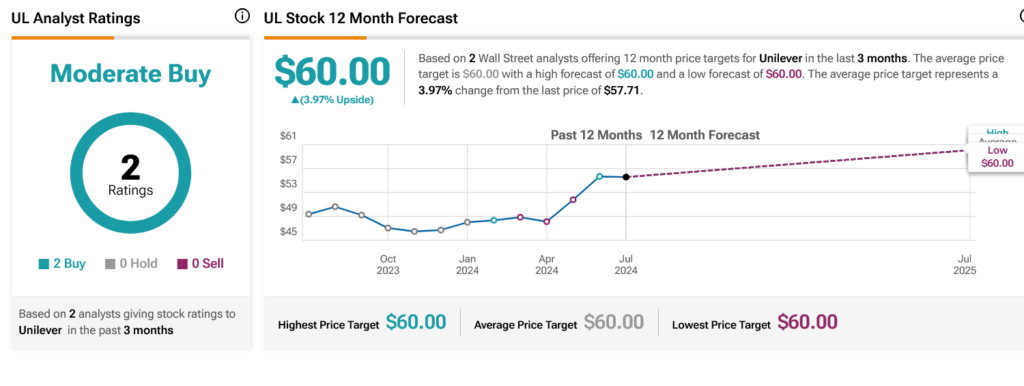

Turning to Wall Street, analysts have a Moderate Buy consensus rating on UL stock based on two Buys assigned in the past three months, as indicated by the graphic below. After a 14.67% rally in its share price over the past year, the average UL price target of $60 per share implies 3.97% upside potential.