CNBC host Jim Cramer appears to be having second thoughts about Eli Lilly’s (LLY) stock.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

For months, Cramer has been pounding the table on LLY stock, going so far as to predict that the pharmaceutical company would be the next stock to reach a $1 trillion market capitalization. Cramer has been bullish on Eli Lilly’s share of the global weight-loss drug market and the company’s upcoming weight-loss pill.

But now, Cramer appears to be changing his viewpoint, recently explaining on his TV show “Mad Money” why Eli Lilly might not be the next to hit the $1 trillion milestone. Cramer said that investors are not “supposed to buy drug stocks” when the U.S. Federal Reserve is cutting rates, and that the current market is a tricky one for pharmaceutical companies.

Ongoing Issues

“Not that long ago, pretty much everybody assumed that the next non-tech stock to cross the trillion-dollar threshold would be the stock of Eli Lilly. Why not? They’ve developed a weight-loss and diabetes wonder drug with incredible prospects,” said Cramer before laying out his bear thesis on the stock.

In addition to interest rates falling, pharmaceutical companies such as Eli Lilly are contending with a difficult political environment in Washington, D.C. U.S. President Donald Trump has threatened tariffs of up to 250% on pharma companies if they don’t invest in America and lower drug prices. President Trump has also linked diseases such as autism to medications and vaccines, raising concerns within the industry.

Is LLY Stock a Buy?

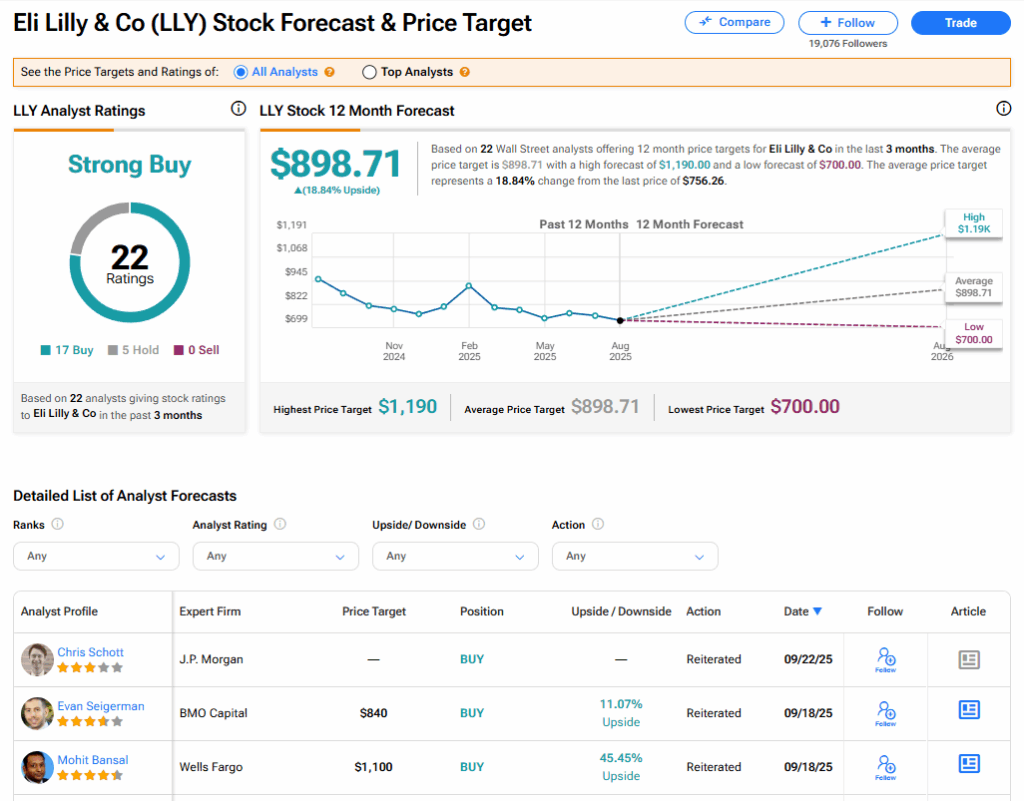

The stock of Eli Lilly has a consensus Strong Buy rating among 22 Wall Street analysts. That rating is based on 17 Buy and five Hold recommendations issued in the last three months. The average LLY price target of $898.71 implies 18.84% upside from current levels.