JD.com (NASDAQ:JD) (HK:9618) shares surged nearly 11% in the early session today after the Chinese tech giant announced robust fourth-quarter numbers and a new share buyback program worth $3 billion.

During the quarter, revenue increased by 3.6% year-over-year to $43.1 billion. The figure exceeded estimates by roughly $1.5 billion. Similarly, earnings per American depository Share (EPADS) of $0.75 outpaced consensus by $0.12. JD is witnessing improved user engagement due to its focus on user experience and price competitiveness. The company is maintaining its sights on driving market share gains in 2024.

Impressively, JD has announced an annual cash dividend of $0.76 per ADS. This translates into dividend distributions worth $1.2 billion. The JD dividend is payable on April 29 to shareholders of record on April 5. Additionally, JD has announced a new share buyback program worth $3 billion. The company plans to execute share repurchases under this authorization over the next 36 months.

What Is the Target Price for JD?

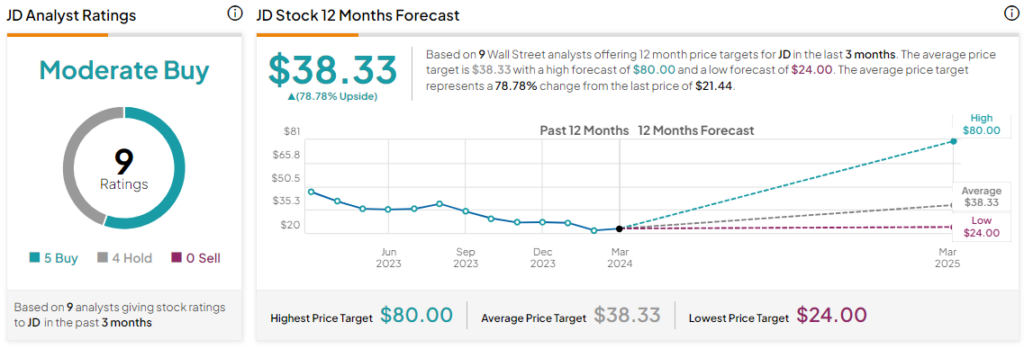

Today’s price gains come after a nearly 54% decline in JD’s share price over the past year. Overall, the Street has a Moderate Buy consensus rating on JD.com alongside an average price target of $38.33. However, analysts’ views on the stock could see a revision following today’s earnings report.

Read full Disclosure