Japan-based Sony Corporation (JP:6758) recorded a 10% year-over-year jump in its operating profit of ¥279 billion for Q1 FY24, surpassing analysts’ average estimate of ¥275 billion. Driven by successful results, Sony upgraded its profit outlook for the full-year Fiscal 2024 by 3% to ¥1.3 trillion. Sony shares lost 0.081% in today’s trading session.

Sony is a conglomerate specializing in the production and sale of electronic equipment and related products.

Sony’s Q1 Performance Across Segments

Among Sony’s segments, Imaging & Sensing Solutions stood out in Q1, with operating income tripling to ¥36.6 billion compared to Q1 2023. This segment, which caters to smartphone manufacturers, was mainly driven by favourable foreign exchange movement and higher sales.

Its Game & Network Services segment also registered higher profits despite selling 2.4 million PlayStation 5 (PS5) units, marking a decrease from 3.3 million in the previous year. Earlier in May, Sony projected to sell 18 million PS5 units in FY24, down from 20.8 million units in FY23.

Meanwhile, Sony’s Music business was the biggest contributor to the company’s operating income, driven by the catalog of best-selling artists. The Music segment registered a 17% year-over-year growth in operating income, reaching ¥85.9 billion. On the flip side, the Pictures business’ profit declined by 29% to ¥11.3 billion.

The total revenue of the company reached ¥3.01 trillion, marking a 2% increase over the prior corresponding period.

Is Sony Stock a Good Buy Right Now?

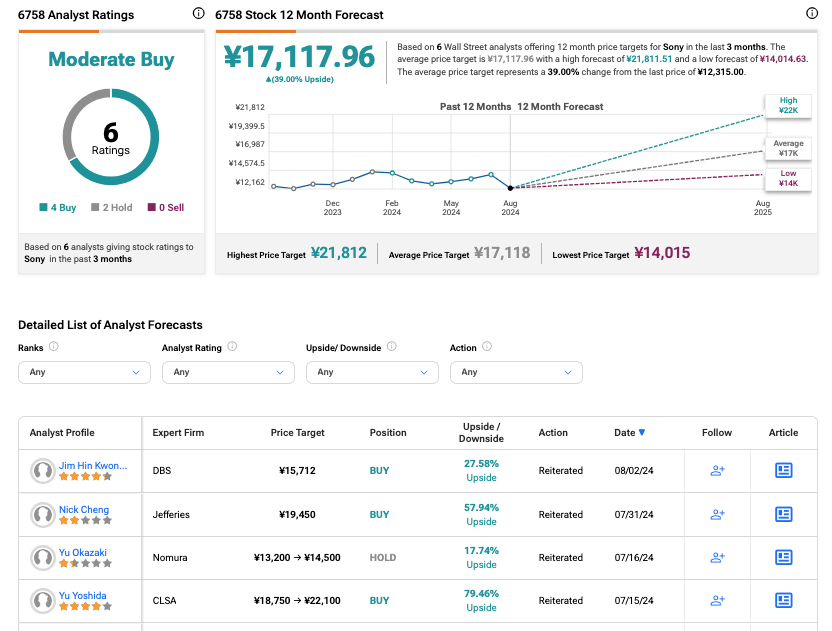

According to TipRanks, 6758 stock has received a Moderate Buy rating based on four Buys and two Hold recommendations. The Sony share price forecast is ¥17,117.96, which is 39% higher than the current price level.