Long checkout lines operated by teams of cashiers seem to be a thing of the past, thanks to self-checkout kiosks pervasive across retail stores, restaurants, and banks. At the heart of this transition sits NCR Voyix (NYSE:VYX), which has carved out a leading market share by providing digital commerce solutions. VYX stock is down 22.65% year-to-date and trades at an attractive valuation. If management can demonstrate positive momentum in revenue and profitability, the stock may be an attractive addition to long-term value investors’ portfolios. However, I’d like to see evidence of that positive momentum before pulling the trigger.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

What Is Going on with NCR?

Founded in 1884, NCR Voyix has evolved into a cloud-based platform recognized as the number one global point-of-sales (POS) software supplier for restaurants, grocery, convenience, and drug stores.

Interestingly, in October 2023, the company transitioned from a supplier of legacy hardware-only products to a cloud-based SaaS solutions provider. Further, the company spun off its ATM business, which is now NCR Atleos (NYSE:NATL), into an independent publicly traded company.

Management believes that the transition was necessary to focus entirely on a growing market that continues to evolve in a fast-paced environment, expand margins, and improve profitability by concentrating solely on high-margin value-added services.

Navigating NCR’s Financial Results

The spin-off of the ATM business impacted NCR Voyix’s 2023 reported results due to discontinued operations, so it’s not entirely clear how to interpret the recently published Q4 and FY 2023 financial results. The company offered normalized results to exclude the impact of certain spin-off and divestiture-related items (which, in my mind, translates to “highly edited and subject to manipulation,” so take it with a grain of salt).

The company reported total revenue of $963 million in the fourth quarter, which was flat year-over-year, as reported. However, it reflected a 1% increase on a normalized basis. For the full Fiscal Year, revenue rose to $3.83 billion, marking a 1% increase as reported and a 2% increase on a normalized basis. Q4 normalized EPS of -$3.42 was a wide miss on expectations of $0.62.

Moving into FY24, management anticipates revenue in the range of $3.6 billion to $3.7 billion, with adjusted EPS projected to be between $0.84 and $0.94. This guidance is in line with expectations and exceeding it would be a strong statement that the post-spin direction is off on the right foot.

Is NCR Voyix Stock a Buy, Hold, or Sell?

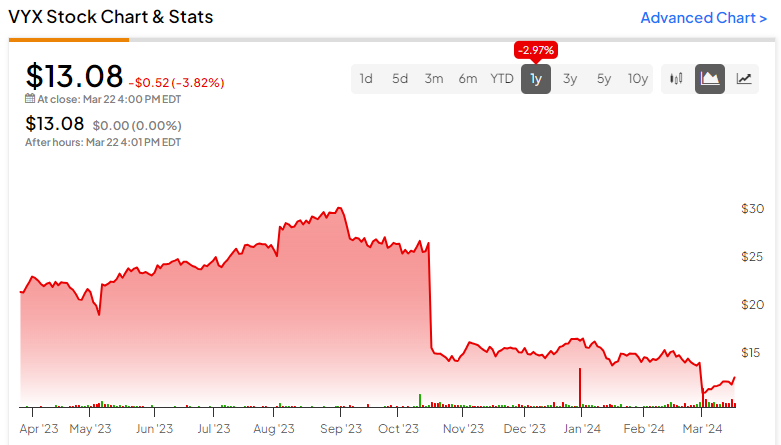

Shares of VYX stock are currently trading at the low end of the 52-week range of $10.99-$19.01 and continue to demonstrate negative price momentum, trading below the 20-day moving average (13.18) and 50-day moving average (14.24).

The P/S (price-to-sales) ratio of 0.5x sits significantly below the Technology sector average of 4.7x and the Information Technology Services industry average of 2.1x. Further, the company’s current EV to EBITDA (9.5x) is below the industry average (14.46x) and its own historical average (11.05x). Overall, the stock is undervalued and trades at a deep relative discount.

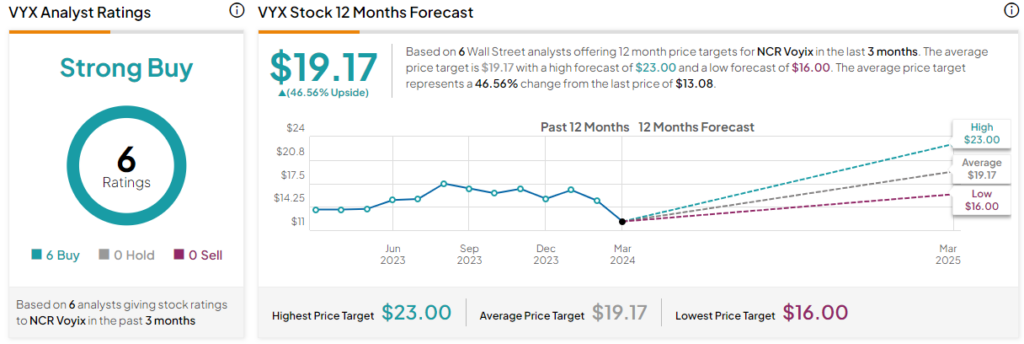

Analysts are bullish on NCR Voyix stock. It is currently rated a Strong Buy based on six unanimous Buys. The average price target for VYX stock is $19.17, representing a 46.56% upside from current levels.

The Big Picture on NCR Voyix

NCR Voyix is in an attractive market leadership position in growing industry verticals. Shares are priced at value levels, and there is plenty of upside to be bullish about. Yet, I’m not one for trying to catch a falling knife.

I would like to see confirmation of the salutatory benefits of the recent spin-off in the financials (the next earnings announcement in early May is a reasonable touch point) and for the price momentum of the shares to turn positive to confirm a reasonable entry point to initiate a position.