Investors are always looking for companies that offer low risk and significant growth potential. Sometimes, like a set of lost keys, it’s staring them right in the face, and Intercontinental Exchange (NYSE:ICE) has been under our noses for some time. However, the company’s recent announcement got investors’ attention. This leading global technology and data services provider is a company with which active investors interact daily. After all, one of its companies is the New York Stock Exchange (NYSE).

This week, the company announced its plans to launch a clearing service for all U.S. Treasury securities and repurchasing agreements. ICE intends to promote transparency and standardized risk management in the Treasury securities market through its expertise.

To say the U.S. treasury market is huge and active is an understatement. This means ICE should be able to take advantage of significant growth opportunities and solidify its place as one of the MVPs in the financial services industry.

What Makes ICE Solid?

ICE operates in several key markets, including trading, clearing, and data management. ICE’s flagship platform, the NYSE, is one of the world’s most well-known and respected security exchanges. The NYSE is a symbol of the U.S. financial market and a critical component of the global financial ecosystem. ICE’s trust in its services, like in the NYSE and other ICE businesses, has few parallels in the financial world, making ICE stocks all the more solid.

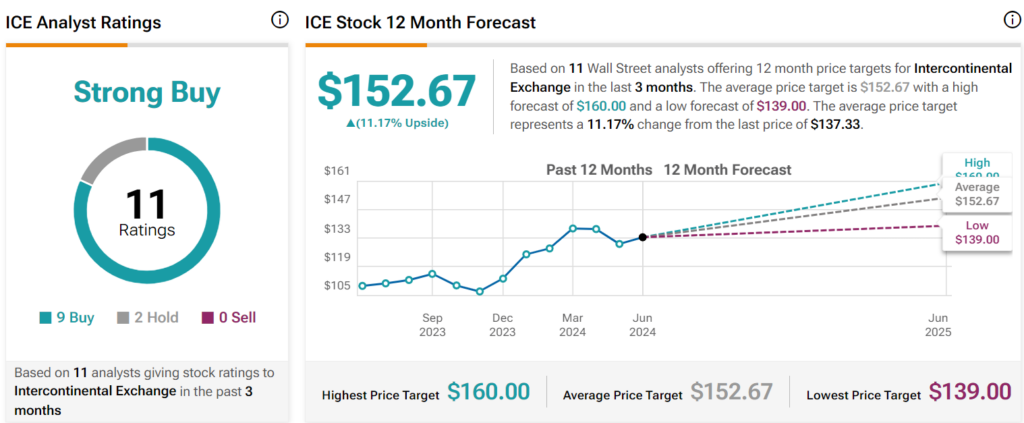

But what do the Wall Street analysts have to say about ICE? According to the TipRanks Stock Forecast and Price Target, out of 11 Wall Street analysts, nine rate it a Buy, two rate it a Hold, and zero rate it as a Sell. This has earned the company a TipRanks Strong Buy rating.

ICE Data Management

In addition to its trading and clearing operations, ICE is also a leading provider of data management services. The company’s extensive data offerings include real-time market data, analytics, and insights, all critical for investors, traders, and financial institutions. ICE’s available market data enable it to provide its clients with a comprehensive view of the global financial markets, helping them make informed investment decisions.

ICE’s New Market: U.S. Treasuries

The U.S. Treasuries market is the world’s most liquid sovereign debt market, with an estimated daily trading volume of over $1 trillion. This market serves as a benchmark for global interest rates and a safe haven for investors during times of financial turbulence. ICE’s launch into treasury clearing services is a significant development for the company and the financial world. As stated above, it could increase transparency and enhance resilience in this crucial market.

Growth Opportunities

ICE’s expansion into the U.S. Treasuries market is expected to provide the company with extraordinary new growth opportunities. The company’s experience and expertise will enable it to offer comprehensive solutions to clients in this market. This move is also expected to attract new customers and increase trading volumes, driving revenue growth for ICE.

Key Takeaway

Investors overlooking ICE may want to glance at it, given the company’s strong market position and growth potential. With its recent announcement of launching a treasury clearing service, ICE is well-positioned to capitalize on the opportunities in the always-expanding U.S. Treasuries market.

As the company continues to widen its offerings and solidify its position as a key player in the financial services industry, investors may want to take a closer look at this underappreciated gem. Maybe they’ll become hot on ICE.