Ferrari’s stock (RACE) has soared in recent years, driven by its consistent financial performance and its status as an iconic luxury brand. With demand for Ferrari vehicles consistently outstripping supply and the company commanding industry-leading margins, it’s no surprise that the stock has become a favorite on Wall Street. Nevertheless, as Ferrari trades at a lofty 51x this year’s projected earnings, many investors are asking if the valuation is sustainable, or whether the market’s love affair with Ferrari has driven shares to overheated levels? I lean toward the latter, which prompts me to adopt a neutral view on RACE stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Ferrari: A Wall Street Darling with Unique Pricing Power

Ferrari is more than just a car company; it is a luxury brand with unparalleled pricing leverage. Investors and consumers alike treat Ferrari as a symbol of exclusivity, and the aura around the brand has translated into margins that more closely resemble the luxury goods industry than the automotive sector. To give you some context, last year, Ferrari posted an EBITDA margin of 38.2%, a figure way more akin to high-end fashion houses than traditional carmakers. Ultimately I’m neutral on the stock though.

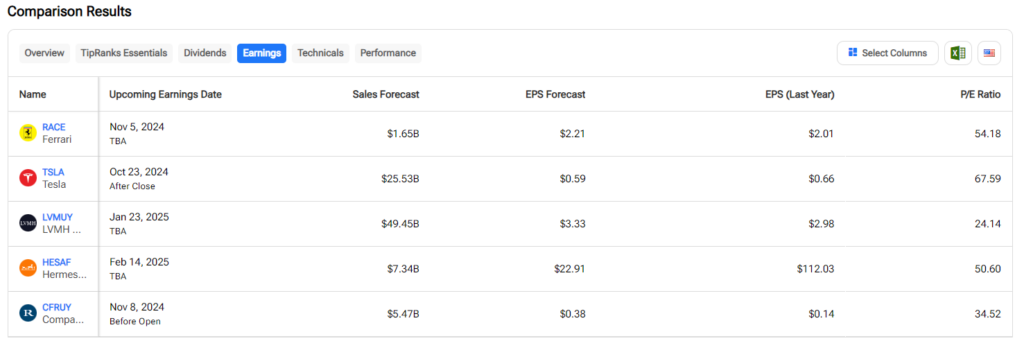

The below table from TipRanks’ stock comparison tool pits Ferrari against some European luxury brands, along with fellow automaker Tesla (TSLA).

This margin strength is a direct result of Ferrari’s brand power and strict production control. The company limits supply to ensure demand consistently outmatches available inventory, with customers often waiting months or even years to receive their vehicles. Last year, about 74% of Ferrari’s cars were sold to existing customers and 40% to current owners of more than one Ferrari, illustrating its appeal as a collector’s brand. It is this exclusivity that allows Ferrari to charge premium prices and even boost personalization offerings, which contributes to excellent financials across the board.

Therefore, you can see why investors have been chasing the stock higher, driven by Ferrari’s ability to deliver strong financials despite the auto industry’s cyclical nature. Operating in the luxury sector gives Ferrari pricing power and demand stability that most carmakers lack. This, however, has led to a notable expansion in the stock’s valuation, as we will explore shortly.

Sustaining Momentum Powered by Strong Tailwinds

While I’ve already referenced Ferrari’s performance from last year, let’s now turn our attention to its latest report, which highlights the company’s ongoing momentum, fueled by a robust set of tailwinds. Ferrari delivered impressive results across the board, satisfying bullish investors and driving its continued stock momentum. I don’t recommend buying the stock here, however.

In Q2, Ferrari achieved net revenues of €1.71 billion, up 16% year-over-year, driven by a more potent product mix and increased demand for personalization. The company’s adjusted EBITDA grew by 14% to €669 million, marking an impressive EBITDA margin of 39.1%. Meanwhile, EPS surged by 25% to €2.29. These numbers were driven by Ferrari’s ability to upsell personalization features and the strong appeal of new models such as the 12Cilindri and 296 GTS.

In addition, management highlighted that a significant part of its success in the quarter was driven by the mix and price variance, which helped improve profitability. This demonstrates why some of Ferrari’s more exclusive models, like the Daytona SP3 and the 499P Modificata, can drive superior margins. In the meantime, Ferrari’s CEO Benedetto Vigna noted during the Q2 earnings call that the company’s order book remains solid, stretching well into 2026, offering substantial revenue visibility.

Is $450 Price Too High to Pay?

While Ferrari’s financial performance is undoubtedly strong, there’s a point where its valuation becomes a concern. At nearly 51x this year’s projected EPS, Ferrari’s stock is priced for perfection. Undoubtedly, Ferrari deserves a premium multiple compared to traditional car manufacturers. Its limited production strategy and the fact that buyers queued up even in economic downturns certainly give it a degree of insulation that others in the industry don’t possess.

However, the question remains: how much of a premium can be justified? While Ferrari’s luxury positioning supports higher-than-average multiples, investors must weigh the risks. At the end of the day, its growth is constrained by its production limits, and even though Ferrari consistently achieves higher margins through personalizations and product mix, it is difficult to argue that the current multiple leaves much room for error. The moment its EPS growth slows down, RACE stock might get punished.

I believe such a scenario is quite plausible. While Ferrari’s EPS growth has been impressive over the years, a big chunk of the stock’s prolonged rally has been driven by expanding valuation multiples. In 2016-2017, shares traded at a forward P/E in the mid-20s, rising to the 30s in the following years and now sustaining levels in the 40s to mid-50s. In my view there’s simple no room left for further multiple expansion. Thus, any future setbacks are likely to test today’s elevated multiples intensely.

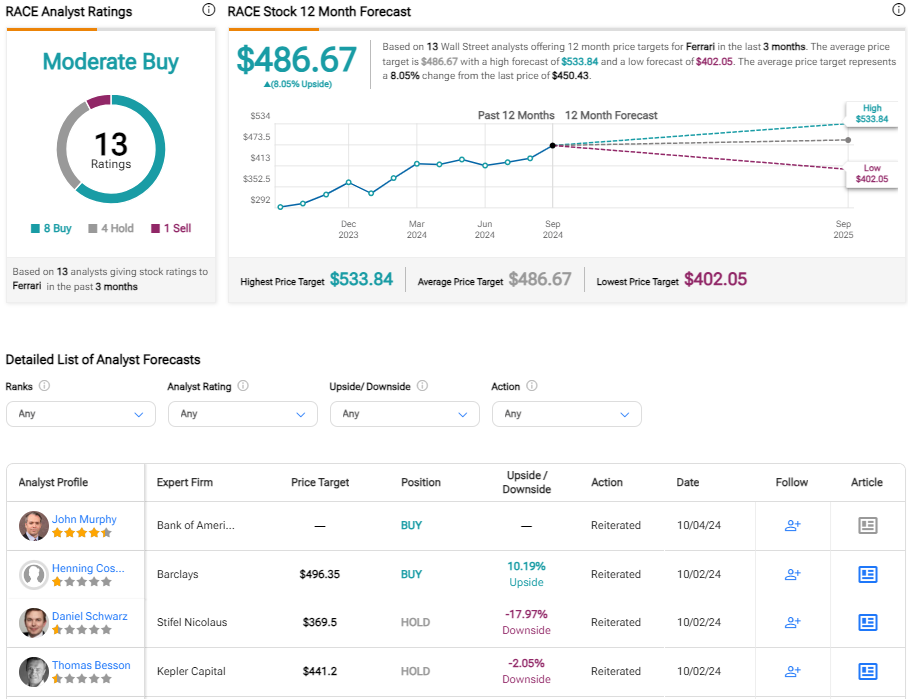

Is RACE Stock a Buy, According to Analysts?

Despite the stock’s prolonged rally and my valuation concerns, Ferrari sustains a Moderate Buy consensus rating from Wall Street based on eight Buys, four Holds, and one Sell assigned in the past three months. At $486.67, the average RACE stock price target implies about 8% potential upside.

If you’re unsure which analyst you can trust the most regarding Ferrari, Michael Binetti is the most accurate analyst covering RACE stock (on a one-year timeframe). He boasts an average return of 38.5% per rating and a 91% success rate.

Final Thoughts

While Ferrari’s performance continues to impress, its stock valuation leaves little room for error. The company’s luxury brand power and financial resilience offer unique advantages, but at 51x this year’s projected earnings, the stock’s lofty multiple introduces significant downside risk. For investors, I would argue that the most burning question is how much the current premium could damage future return prospects. With the possibility of a margin compression from any future setback, a cautious, neutral stance on RACE stock seems prudent moving forward.