Ferrari (RACE) gets an A+ for momentum. The stock has gone from strength to strength in 2024 and is up 56.3% over 12 months at the time of writing. However, despite its incredible margins and loyal customer base, I’m bearish on the carmaker, noting potential limitations to margin and volume expansion. I’d look elsewhere for auto stocks. In fact, I have a limited position in high-risk, high-reward peer Aston Martin (GB:AML).

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The Ferrari Investment Thesis

Let’s start by addressing why people invest in Ferrari instead of other automakers. Ferrari is an iconic Italian luxury sports car manufacturer, offering a unique position within the high-end market, and has demonstrated its ability to maintain consistent growth and profitability. Unlike many luxury brands that have become increasingly similar and reliant on aspirational consumers, Ferrari maintains a distinct identity and caters almost exclusively to the ultra-wealthy.

And this is in the brand’s DNA. Summarizing founder Enzo Ferrari’s vision in 2022, CEO Benedetto Vigna said, “Ferrari will always deliver one car less than the market demand.” With annual production limited to around 14,000 units, Ferrari creates genuine scarcity, driving demand and preserving its exclusivity. This scarcity also creates pricing power.

The company’s ability to control its production and sales gives it extraordinary financial predictability and pricing power, which have allowed Ferrari to consistently expand margins and achieve double-digit earnings growth.

Moreover, this exclusivity has created a very loyal and ultra-rich customer base. Interestingly, there are 630,000 ultra-rich people worldwide, a population that is growing faster than the number of annual Ferarri deliveries. This makes it a large addressable market considering Ferrari’s production volume.

Ferrari Keeps on Outperforming

While I understand the business model very well, I must confess that Ferrari’s recent outperformance has surprised me. In Q2, the company reported 16.2% year-over-year revenue growth to €1.7 billion, surpassing analyst estimates by nearly 6%.

Moreover, Ferrari’s adjusted EBIT margin improved by 20 basis points to 29.9%, with EBIT coming in at €511 million, representing a 17% increase. Most importantly, earnings per share (EPS) grew by 25% to €2.29, beating estimates by €0.21.

However, this outperformance has surprised me primarily because of two reasons. Firstly, Ferrari’s growth must either be driven by margin expansion or volume expansion. However, the latter can only happen very slowly because scarcity is key to its pricing power.

Likewise, Ferrari’s margins are already the envy of the industry. During the Q2 earnings call, one analyst noted that margins were already at the top end of 2026 guidance and asked whether revising margin expectations was in the cards. However, management pointed to additional costs in H2 of 2024 and didn’t comment on 2025 and 2026. Personally, I believe this to be a sign that further margin expansion could prove challenging, but I’m ready to be proven wrong.

Ferrari’s High-Octane Valuation

Given my reservations concerning volume and margin expansion, I’m naturally concerned by the company’s valuation metrics. The stock is trading at 53.5x forward earnings and has a price-to-earnings-to-growth ratio of 3.87. These figures suggest a vastly overbought stock.

However, not everyone shares my opinion, clearly. Recently, several analysts raised their price targets for Ferrari despite its strong year-to-date rally. Bernstein boosted its target to $599, implying over 20% upside, while Morgan Stanley raised its target to $520. Analysts cite Ferrari’s control over shipments, revenue recognition, and earnings, as well as its low China exposure and strong brand loyalty, as key factors driving their optimistic outlook.

Is Ferrari Stock a Buy According to Analysts?

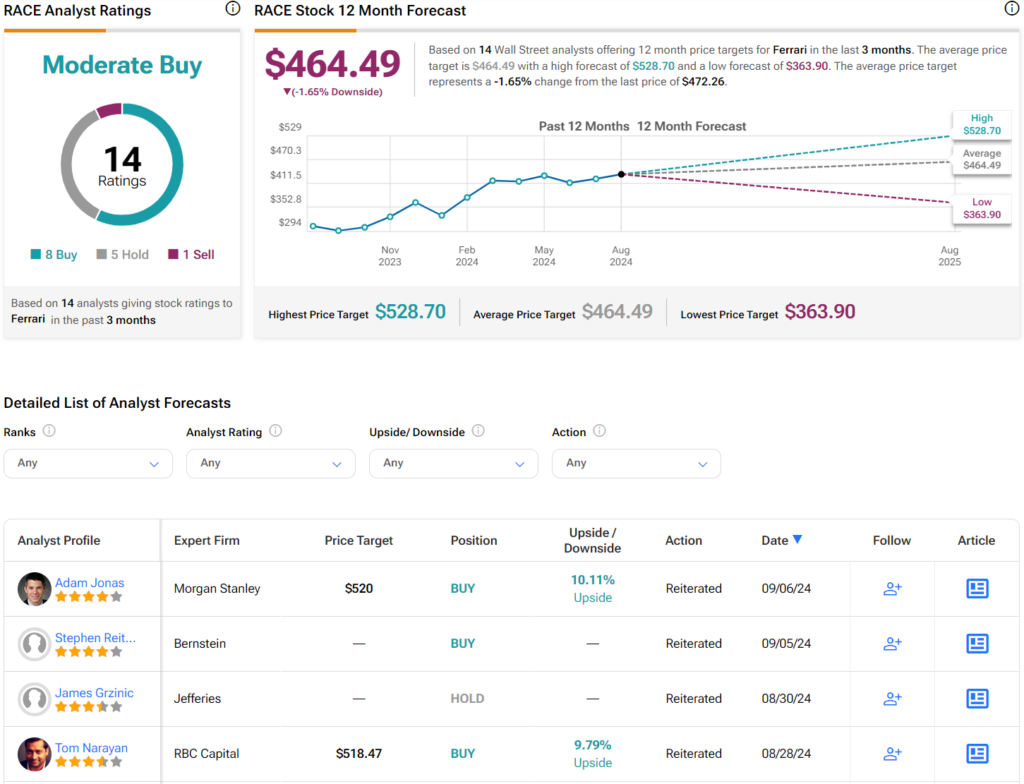

On TipRanks, RACE comes in as a Moderate Buy based on eight Buys, five Holds, and one Sell rating assigned by analysts in the past three months. The average Ferrari stock price target is $464.49, implying a 1.65% downside risk.

Takeaway – Valuation Is a Concern

Ferrari is a quality company, and every investor should aim to buy top-quality companies — that’s what Warren Buffett tells us. However, I’m still very concerned about the stock’s valuation in light of the company’s potential limitations when it comes to margin and volume expansion. While volume expansion threatens the business model, margin expansion may prove challenging from this incredibly high starting point. As a result, Ferrari may well be priced for perfection.