After steadily losing ground since mid-December, Duolingo (NASDAQ:DUOL) stock soared by more than 20% after a strong earnings report. The educational app achieved revenue and net income growth, which are often the hallmarks of a productive quarter. The big rally brought the stock close to where it traded in mid-December, and any surge is bound to attract attention from the market. However, the stock has had a bumpy history. Shares reached $200 in September 2021, only to fall to under $70 in November 2022.

A shift to profitability and high growth rates suggest that the stock won’t see $70/share anytime soon — if it ever reaches that point. However, a lot of volatility and a sudden post-earnings spike may have some investors cautious. I am neutral on this stock and will share some insights into Duolingo’s outlook after earnings.

Growth Remains Strong

Duolingo’s educational app has been growing at a rapid pace. In fact, the company’s daily active user growth rate accelerated in each quarter. DAU growth came in at 65% year-over-year in the fourth quarter. Duolingo now has 26.9 million daily active users and 88.4 million monthly active users. MAUs were up by 46% year-over-year.

Total revenue increased by 45% year-over-year. That’s an acceleration from the 43% year-over-year revenue growth rate posted in the third quarter.

Although these growth numbers are solid, net income was the big number from this earnings report. The company reported $12.1 million in net income compared to a $13.9 million net loss in the same period last year. Duolingo reported less than $3 million in net income in Q3. Meanwhile, Q2 2023 was the company’s first profitable quarter.

Duolingo’s $12.1 million in net income and $151.0 million in total revenues resulted in an 8.0% net profit margin. That’s a big increase compared to the 2.0% net profit margin in Q3. I believe the company can reach double-digit net profit margins as growth continues to surge. Duolingo’s use of artificial intelligence has strengthened revenue growth and net profit margins, and it looks like that trend is here to stay.

The Risks

Although Duolingo released an exceptional earnings report, a great company isn’t always a great stock. Duolingo’s valuation is a giant risk for new investors. The stock currently trades at a forward P/E ratio above 300.

At current levels, Duolingo does not have the flexibility to report slower growth rates in upcoming quarters. The company needs to maintain its revenue growth of above 40% per year while having net income grow at a faster rate.

Growth doesn’t need to come to a screeching halt for the stock to experience a sharp correction. Even a slight earnings miss or unfavorable macroeconomic news can rattle the stock. This is an immediate risk that will come up in every quarter. On the other hand, Duolingo can continue to march higher if it consistently delivers earnings reports like its Q4 results.

The firm generated $531.1 million in total revenue in 2023, and guidance calls for $723.5 million in revenue in 2024 at the midpoint. That’s a 36.2% year-over-year increase if Duolingo reaches the midpoint of its guidance.

As you may have noticed, the guidance points toward a slight deceleration in revenue. Rapid net profit margin expansion can mitigate the effects of lower revenue growth. However, if Duolingo’s net profit margins continue to hover near 10%, investors may not be as receptive to lower growth rates.

Artificial intelligence also presents a risk. If free AI tools can replicate Duolingo or offer a similar experience, people may opt to use those resources instead and save money on subscriptions. Still, I do not see this scenario meaningfully impacting Duolingo’s business model in 2024 or for several years (if that point ever arrives).

Is DUOL Stock a Buy, According to Analysts?

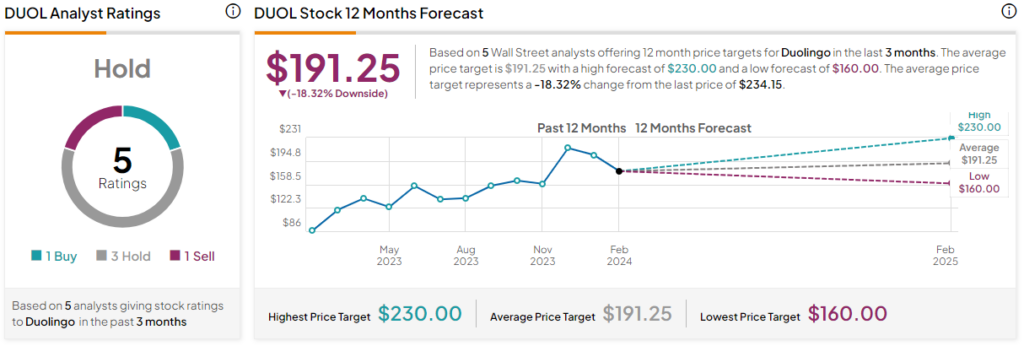

Analysts aren’t very optimistic about Duolingo. The stock has a Hold rating with one Buy, three Holds, and one Sell rating assigned in the past three months. The stock has 18.3% downside potential, according to the average DUOL stock price target. However, these price targets do not reflect the stock’s earnings report.

The stock earned a few bullish ratings on the day earnings came out. The company has price targets of $260, $275, and $282 that reflect its earnings report. The high price target of $282 per share implies 21.3% upside potential.

The Bottom Line on Duolingo Stock

Duolingo is achieving exceptional growth rates and has expanded its net profit margins. The educational app offers a lot of promise as it expands beyond languages. Other subjects like math and music have been added and increased the company’s total addressable market.

However, the valuation is too high for investors to ignore. Investors willing to wait five to 10 years may see the valuation get better and end up with substantial gains. Plus, growth doesn’t seem to be a problem for the company. Investors who are worried about the valuation may want to monitor this stock and wait for a correction before accumulating shares.