Networking solutions and IT infrastructure leader Cisco Systems (CSCO) is set to report its Fiscal Q1 earnings on November 13. The company aims to sustain the strong momentum from last quarter, when it announced a restructuring plan, provided an optimistic outlook for revenue growth, and, as usual, delivered a beat across the board. This strengthens my bullish outlook for the stock ahead of the earnings report.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

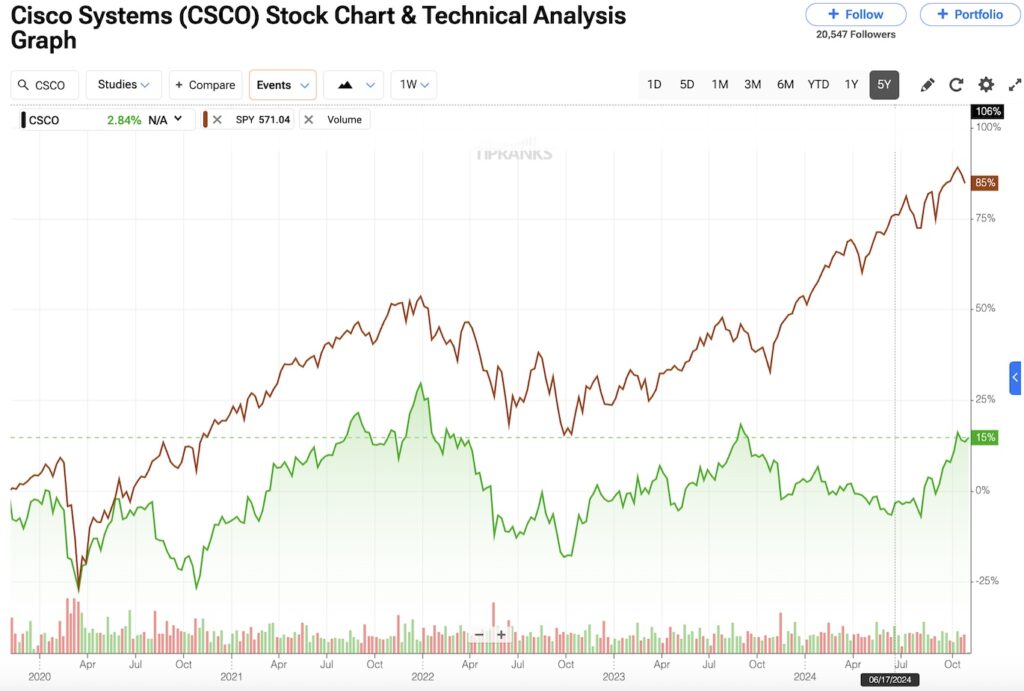

Despite underperforming the market over the past five years, Cisco remains a strong value investment, at least in theory. The company boasts solid returns on invested capital and trades at attractive multiples, making it an appealing candidate for a buy-and-hold strategy.

In this article, I’ll outline why I’m optimistic about Cisco, the reasons for its recent momentum, and what to expect from its Fiscal Q1 earnings.

Why I Like Cisco Systems

Cisco’s business is somewhat cyclical and tends to correlate with broader economic trends, particularly during periods of stability. This is the primary reason I hold a bullish long-term stance on the company.

Not surprisingly, Cisco has a five-year beta of 0.82, indicating a moderate level of correlation with major indexes. However, the nature of the network solutions industry allows Cisco’s financial results to be somewhat forward-looking, often disconnected from the immediate economic activity of end consumers. As a result, Cisco’s performance has significantly lagged behind the S&P 500 (SPX) over the past five years.

Despite the underperformance in its stock price, Cisco’s fundamentals tell a different story. The company has an impressive track record of profitability, with generally increasing earnings per share over the last five years and no years of negative earnings. Efficiency metrics further highlight Cisco’s strength, with an average return on equity (ROE) of 28% over the past five years, demonstrating its ability to generate significant net profits relative to its net assets.

CSCO Is a Value Investing Pick: ROIC and Earnings Yield

One of the key reasons I view Cisco as a strong long-term buy-and-hold stock is its ability to invest capital effectively. Take, for example, Cisco’s Return on Invested Capital (ROIC), which is calculated by dividing NOPAT (Net Operating Profit After Taxes) by invested capital. For Fiscal 2024, Cisco’s NOPAT for the year ending on July 27 was $10.27 billion, considering an effective tax rate of 15.6%.

Invested capital includes:

- Fixed assets: $2.1 billion

- Net working capital: -$3.72 billion (due to high payables and slow inventory turnover)

- Intangibles and goodwill (after subtracting deferred taxes and other assets): $57.7 billion

Thus, Cisco’s ROIC for Fiscal 2024 is approximately 18.3% (calculated as $10.27 billion divided by $56.08 billion of invested capital). Whether we apply a cost of capital of 8% or 15%, Cisco remains highly efficient at generating value for its shareholders.

Additionally, considering earnings yield, Cisco stands at a forward multiple of 6.3%, based on $3.57 EPS for Fiscal 2025, surpassing the long-term U.S. Treasury yield of 4.3%. This is a positive sign, as it suggests Cisco offers a higher potential return for investors and a favorable balance between risk and return. It may also indicate that the company’s shares are undervalued relative to its profits.

Cisco’s Drag May Finally End

The bearish investment thesis on Cisco took a major turn following the company’s Fiscal Q4 earnings report in August, where Cisco exceeded both top and bottom-line estimates. Earnings per share (EPS) came in at $0.87, beating expectations by $0.02, while revenue of $13.64 billion exceeded forecasts by $100 million. Cisco also closed Fiscal 2024 with revenue at the high end of its guidance range, $53.8 billion, and reported gross margin reaching the highest level in two decades at 67.5%.

Since the earnings release, Cisco’s stock price has surged more than 22%, with the market anticipating a return to revenue growth in Fiscal 2025. Although Cisco’s revenue for Fiscal 2024 was down 5.6%, this decline was largely due to the company shipping products in 2023 to clear its backlog. As this excess inventory clears, Cisco expects revenue to improve moving forward.

A major catalyst for the stock’s recent jump was the announcement of a restructuring plan, which includes cutting 7% of the workforce. This move is expected to result in estimated pre-tax savings of $1 billion.

Additionally, Cisco’s acquisition of Splunk, which closed in Fiscal Q3, presents new growth opportunities. Cisco has already identified 5,000 existing customers who could become significant Splunk clients, and the company plans to integrate this acquisition over the coming weeks. Furthermore, Cisco expects to generate $1 billion in AI product orders in Fiscal 2025, though this still represents less than 2% of total revenue guidance, which is between $55 billion and $56.2 billion.

What to Expect from Cisco’s Fiscal Q1 Earnings

I have a bullish outlook for Cisco ahead of its Fiscal Q1 earnings, largely based on its strong track record of consistently beating estimates. Over the past 20 quarters, Cisco has only missed revenue estimates twice (in Q3 2022 and Q1 2022) and has never missed EPS estimates.

Given that Cisco typically experiences modest top-line growth in the low single digits and exhibits relatively low volatility, surpassing estimates has become a key driver for more bullish reactions to the stock. Over the last three months, including the clearing of excess inventory and the closing of new AI-related contracts, ten analysts have raised their revenue estimates, while 14 have revised their EPS estimates upwards.

This suggests a slightly higher bar for Cisco in Fiscal Q1, though its nearly flawless track record indicates the company should beat expectations once again. Last quarter, the restructuring announcement and layoffs were the catalysts for the stock’s rally, rather than an unexpected earnings beat. This time, however, I don’t anticipate any major surprises – unless Cisco delivers results significantly above its annual guidance, which could trigger a more positive market reaction.

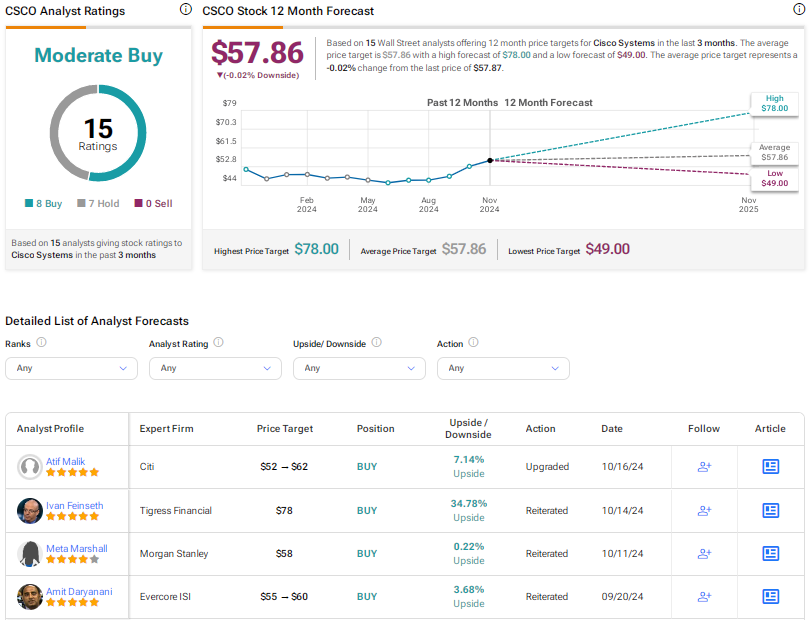

Is CSCO a Buy, According to Wall Street Analysts?

At TipRanks, Cisco stock has a Moderate Buy consensus rating, formed by eight Buy recommendations and seven Holds. The average price target is $57.86, suggesting that the stock is fully valued at the current levels.

Conclusion

I remain bullish on Cisco due to its strong financial track record, solid returns on invested capital, and attractive valuation. Despite reaching maturity, Cisco’s strategic initiatives, such as restructuring and its push into AI, position it for continued, albeit modest growth. As a result, I see CSCO as a Buy ahead of its Fiscal Q1 report. With expectations for another earnings beat, Cisco is well-positioned to sustain momentum, particularly in its top line.