Bloom Energy (NYSE:BE), a clean energy company, has experienced a 53% surge in its stock price after being recognized as a potential beneficiary of increased demand in artificial intelligence (AI) data center power needs. With AI data centers struggling to get sufficient power from the main grid, this could result in a long-term growth opportunity for the company. That said, given the stock’s lofty valuation, investors may want to hold off and look for further progress that could justify the premium.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Also, despite numerous positives, Bloom Energy still faces significant challenges. Specifically, lower-than-anticipated bookings and enduring barriers could potentially hamper the company’s progress.

Bloom Energy’s Fuel Cell Technology

Bloom Energy produces fuel-cell servers that generate on-site electricity, enabling customers to reduce reliance on the traditional power grid. The company uses a solid oxide platform to convert natural gas, biogas, or hydrogen into electricity without combustion, resulting in low or no CO2 emissions.

The company’s fuel cells have proven beneficial to institutions like military facilities and hospitals that require constant and reliable electricity. Further, the technology also delivers an efficient power solution for data centers requiring reliable electricity. It can be integrated with utility power for a dual-source energy solution or function independently, thereby avoiding transmission infrastructure.

Recently, Bloom Energy announced a power capacity agreement with Intel Corporation (NASDAQ:INTC) to install additional fuel cell-based Energy Servers at Intel’s high-performance computing data center in Santa Clara, CA. This addition expands an existing installation from 2014, making it the largest fuel cell-powered high-performance computing data center in Silicon Valley.

Bloom Energy’s Recent Financials

Bloom Energy reported disappointing financial results for Q1 2024. The company posted revenue of $235.3 million, a 14.5% decrease year-on-year. The top line fell $14.07 million short of projected figures. Product and service revenue also dropped by 10.5% to $209.8 million. Also, non-GAAP EPS of -$0.17 missed estimates by $0.06.

The company has moved to take advantage of the recent spike in share price and announced its plan to offer $350,000,000 principal amount of green convertible senior notes due 2029, subject to market and other conditions. There’s also an expectation to give the initial purchasers an option to buy up to an additional $52.5 million principal amount of notes within 13 days from the issuance date. The company intends to use $141.8 million of the net proceeds from the offering to repurchase $115.0 million worth of its outstanding 2.50% Green Convertible Senior Notes due 2025. The remaining proceeds will be allocated to general corporate purposes, including research and development, sales and marketing, administrative matters, and capital expenditures.

Management has maintained its forecast for the full-year Fiscal 2024. The projected revenue is expected to be between $1.4 billion and $1.6 billion. The non-GAAP gross margin is anticipated to be around 28%. Non-GAAP operating income is estimated in the range of $75 million to $100 million.

What Is the Price Target for BE Stock?

Analysts following Bloom Energy have been cautiously optimistic about the stock. For example, Wells Fargo analyst Michael Blum recently raised the price target from $12 to $14 while maintaining an Equal Weight rating on the shares. Blum noted that data center orders are picking up, but the timing of larger deals is uncertain.

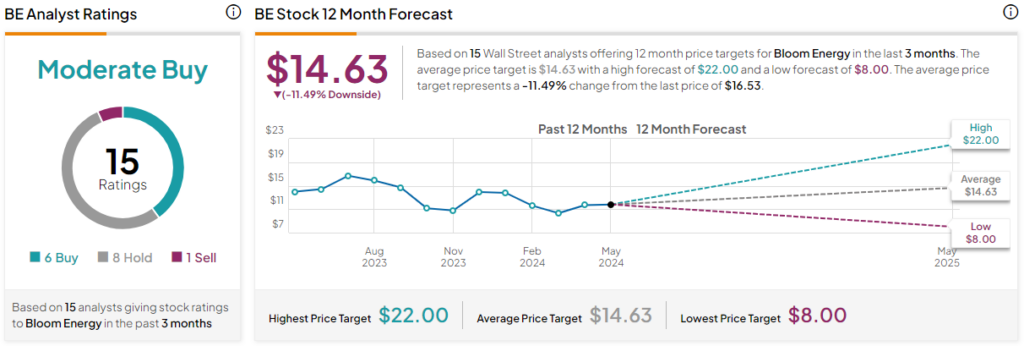

Overall, Bloom Energy is rated a Moderate Buy based on the recommendations and price targets assigned by 15 analysts over the past three months. The average price target for BE stock is $14.63, representing a potential downside of 11.49% from current levels.

BE stock is highly volatile but has recently been trending upward, climbing over 88% in the past 90 days. It sits at the upper end of its 52-week price range of $8.41-$18.76 and continues to show positive price momentum, trading above the 20-day (13.14) and 50-day (11.93) moving averages. The shares are relatively overvalued with a P/S (price-to-sales) ratio of 2.78x, compared to the Electrical Equipment & Parts industry average of 1.37x.

Bottom Line on Bloom Energy

Bloom Energy is well-positioned to benefit from the increasing demand for clean energy in AI data center power. The company’s recent high-profile agreement with Intel Corporation to expand its fuel cell-based Energy Servers bodes well for its future growth prospects. However, the company’s journey is not without hurdles, as evidenced by its disappointing financial results. Given the stock’s lofty valuation, investors may want to closely monitor the company’s advances before taking action.