AstraZeneca (NASDAQ:AZN) (LSE:AZN) trades at a premium to most of its big-pharma peers, with the exception of weight-loss giants Eli Lilly (NYSE:LLY) and Novo Nordisk (NYSE:NVO). However, I’m bullish on AstraZeneca, recognizing its above-average growth expectations, ambitious revenue targets, and long-term demand for novel treatments, especially within oncology.

AstraZeneca’s Bold Targets

Ahead of its Investor Day in May, AstraZeneca unveiled an ambitious plan to achieve $80 billion in total revenue by 2030, driven by the introduction of 20 new medicines. This announcement follows the company’s 2023 revenue of $45.8 billion, itself marking the achievement of a significant revenue milestone.

According to CEO Pascal Soriot, AstraZeneca’s oncology, biopharmaceuticals, and rare disease portfolios have the potential to transform lives and fuel this revenue growth. The company also aims to boost its core operating margin to the mid-30s percentage by 2026 and sustain it, leveraging its innovative pipeline and higher-margin medicines.

Behind this plan are the 20 new medicines, several of which have the capacity to become blockbuster drugs, according to the company. In fact, AstraZeneca believes that many of these 20 new drugs will deliver more than $5 billion annually in peak sales.

However, according to Jefferies, the $80 billion target wasn’t out of the blue, noting that AstraZeneca has one of the strongest, potentially “best-in-class” pipelines despite a lack of major new drug catalysts until 2025.

AstraZeneca’s Pipeline

AstraZeneca’s pipeline and prospects are considered positive due to several strategic factors. The company has emerged as a leader in the oncology market, significantly driven by its innovative cancer therapeutics and five medicines: Tagrisso, Imfinzi, Calquence, Lynparsa, and Enhurtu. The Cambridge, UK-based firm is aiming to develop medicines to treat at least half of potential cancers while furthering research into alternative treatments to chemotherapy and radiotherapy.

For instance, Tagrisso, which recently gained approval in Japan for first-line treatment of specific non-small cell lung cancer (NSCLC) mutations, generated $1.6 billion in sales in Q1 2024 alone. Meanwhile, Enhertu saw a remarkable 79.4% sales increase, driven by its efficacy in treating metastatic HER2-positive breast cancer and NSCLC.

The company’s revenue growth will also be driven by the release of promising new molecular entities (NME) like saruparib — an NME in development for hormone-sensitive prostate cancer — and volrustomig — currently being tested in Phase III against cervical cancer.

The acquisition of Fusion Pharmaceuticals is expected to help AstraZeneca develop more targeted treatments. The expansion of AstraZeneca’s antibody-drug conjugate (ADC) manufacturing capabilities, particularly with the new facility in Singapore, underscores its commitment to cutting-edge treatments. ADCs are expected to gradually replace traditional chemotherapy and radiation.

Is AstraZeneca’s Valuation Justified?

With the exception of Eli Lilly and Novo Nordisk, which trade with very high near-term valuation metrics, AstraZeneca trades at a premium to the likes of Pfizer (NYSE:PFE) and Johnson & Johnson (NYSE:JNJ). AstraZeneca is currently trading around 19.6x forward earnings versus Pfizer at 10.1x and Johnson & Johnson at 13.2x.

However, as always, the justification lies in the growth forecast. AstraZeneca is expected to register stronger earnings growth than its peers over the medium term. The British company’s price-to-earnings (P/E) ratio will fall to 16.4x in 2025 and 14.4x in 2026 based on the current growth projections.

Current forecasts suggest an annualized growth rate of 12.4% over the next five years. It turn, that leads to a price-to-earnings-to-growth (PEG) ratio of 1.5x. Of the major pharma and biotech companies, only Pfizer has a lower PEG ratio.

When looking at valuation, it’s important to consider the long-term demand and growth in pharma and biotech. This is a sector that will benefit from aging populations, the ongoing need for innovative treatments, and continuous research and development. The rising prevalence of chronic diseases and the expansion of healthcare access globally ensure sustained demand.

Is AstraZeneca Stock a Buy, According to Analysts?

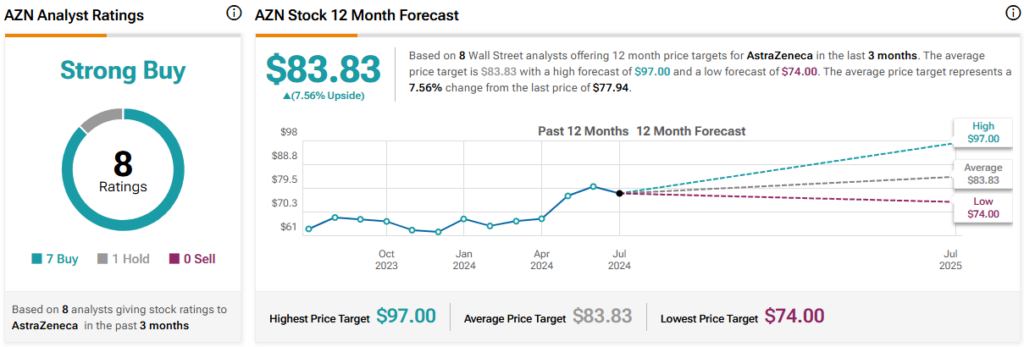

On TipRanks, AZN comes in as a Strong Buy based on seven Buys, one Hold, and zero Sell ratings assigned by analysts in the past three months. The average AstraZeneca stock price target is $83.83, implying 7.6% upside potential.

The Bottom Line on AstraZeneca Stock

AstraZeneca is one of the most exciting companies in the biotech and pharma space, and that’s reflected in the stock’s premium valuation compared to many of its peers. Management is looking to grow revenue significantly to $80 billion over the medium term, which contributes to analysts’ expectations for strong earnings growth — around 12.3% annually through 2029.

While AstraZeneca may look a little expensive on near-term valuation metrics (its 19.6x forward P/E ratio), the expected earnings growth coupled with long-term demand for healthcare is justification. Moreover, AZN stock’s PEG ratio is among the cheapest in this sector.