Meta Platforms’ (META) recent record-breaking 20-day rally drove its share price to an all-time high on February 14, which led to speculation about a potential stock split, according to Bloomberg. Interestingly, the social media giant is the only tech megacap company to never split its stock, which now hovers around $700. Therefore, Meta may consider a split in order to make its shares more accessible to retail investors.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

However, it is worth noting that a stock split would not change Meta’s underlying fundamentals. Instead, it would lower the price per share and make it more attractive to smaller investors. Companies like Nvidia (NVDA) and Broadcom (AVGO) have performed stock splits in the past after significant rallies. In addition, analysts often view splits as a sign that management is confident in a company’s future earnings growth.

Still, the potential benefits of a stock split are more than just making the share price more attractive to retail investors. It can also help a company meet the eligibility requirements for certain indices and improve bullish sentiment. In fact, according to Bank of America analysts, the average return for stocks one year after a split is over 25% versus the 12% for the broader market.

Is META Stock a Good Buy?

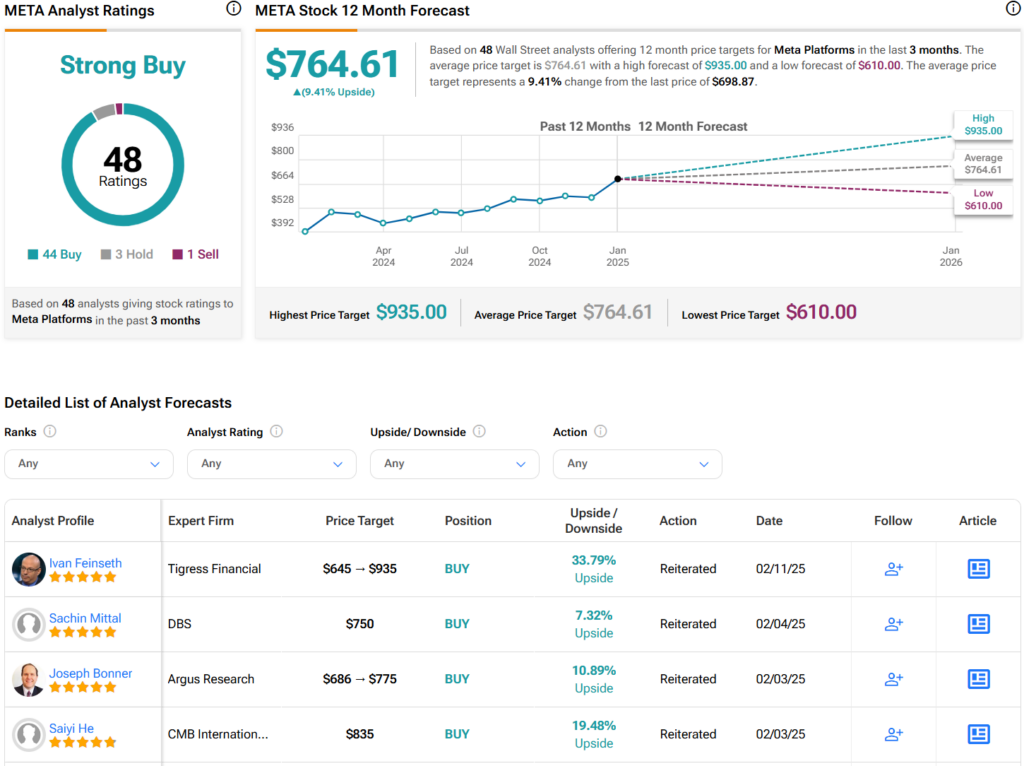

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 44 Buys, three Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 50% rally in its share price over the past year, the average META price target of $764.61 per share implies 9.4% upside potential.