Top executives from Meta Platforms (META) and Alphabet (GOOGL) have amped up the heat on the European Union (EU) over its perceived failure to foster innovation in artificial intelligence, underscoring how much Silicon Valley is aligning itself with President Trump these days. Their comments, reported by CNBC today, appeared to lend weight to the perception in the White House that Europe is stifling AI through too much regulation.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

META and GOOGL Weigh In

In particular, the EU’s AI Act, which tightly controls the type and nature of AI systems allowed in the bloc, was seen as going “too far” by META director of public policy Chris Yiu. Speaking at the Techarena tech conference in Stockholm, he said, “The net result of all of that is that products get delayed or get watered down and European citizens and consumers suffer.”

CNBC also quoted Dorothy Chou, Google DeepMind’s head of public policy, who pointed out that the AI Act was devised before ChatGPT had come out. “There is a way to use policy to create a better investment environment when it’s done in a way that promotes business” Chou said, according to the news provider.

The EU AI Office recently published a second-draft code of practice for general-purpose AI (GPAI) models in December. META indicated it would not sign up to the code in its current form, while Google’s president of global affairs, Kent Walker, told Politico it was a “step in the wrong direction.”

U.S. big tech companies have had a rocky relationship with the EU over the years. From privacy laws to antitrust regulations and fines, the two have been poacher and gamekeeper.

META CEO Mark Zuckerberg lately urged President Trump to stop the EU from fining U.S. tech companies, which he says were forced by the EU to pay more than $30 billion for legal violations over the past two decades.

And as the U.S. and EU square up over AI they are also jockeying over trade and tariffs, which could sweep the likes of GOOGL and META into the mix. The EU, which has promised “firm and proportionate countermeasures” to any U.S. tariffs could, for instance fall back on its “anti-coercion instrument” to attack tech firms. The ACI is a powerful tool devised in 2023 as a deterrent to China that enables it to more easily impose restrictions on trade in services.

U.S. and EU Visions for AI Differ

It comes amid a fierce debate between the EU and U.S. over the future of AI development, as seen at the recent summit in Paris, where Vice President JD Vance urged Europe to look at the rise of AI with “optimism rather than trepidation.”

He said “massive” regulations on AI could strangle the technology and rejected content moderation as “authoritarian censorship.” It culminated in the U.S. and the UK refusing to sign a declaration on “inclusive and sustainable” artificial intelligence.

Is META a Good Stock to Buy?

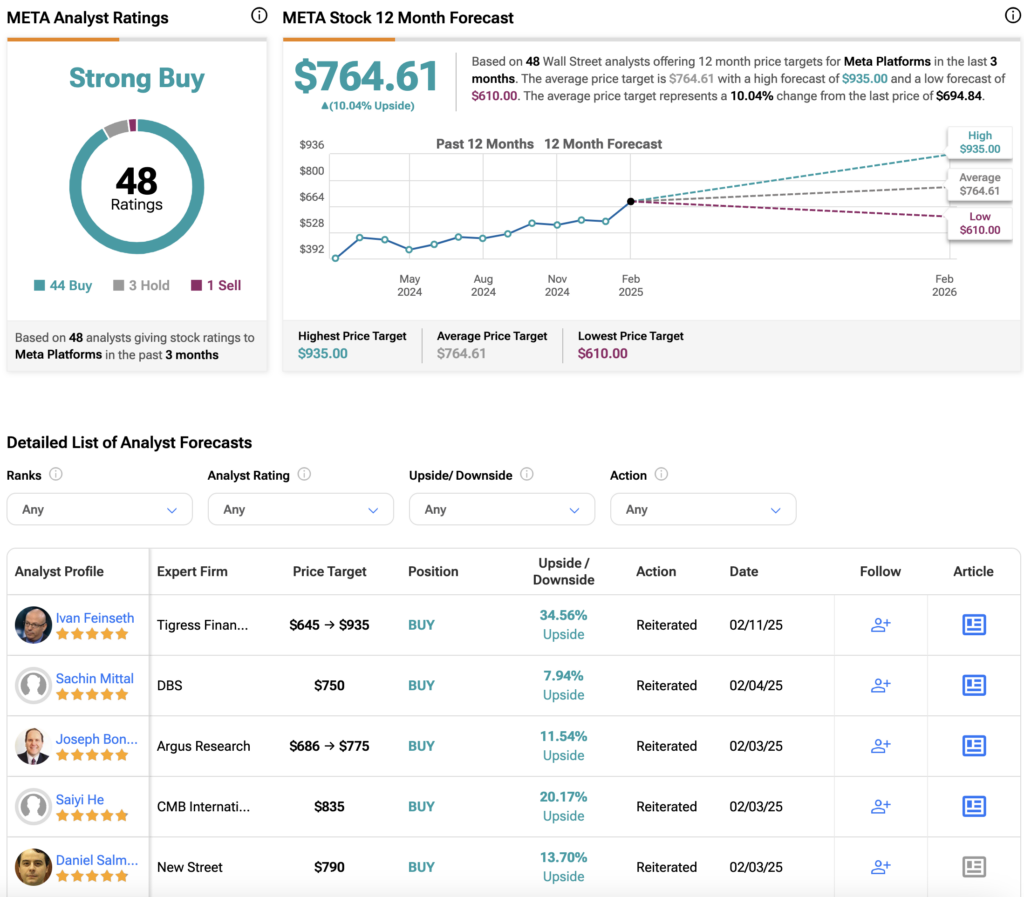

Overall, Wall Street has a Strong Buy consensus rating on META stock, based on 44 Buys, three Holds and one Sell. The average META price target of $764.61 implies about 10% upside from current levels.