Investors appear to be feeling cautious ahead of the U.S. Federal Reserve’s expected interest rate cut on Sept. 18.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Interactive Brokers (IBKR) says that reduced net buying on its trading platform suggests that investors are in a cautious mood before the Federal Reserve announces its latest decision on interest rates. Markets widely expect the U.S. central bank to lower interest rates for the first time in four years, with traders evenly split on whether it will be a 25 or 50-basis point reduction.

Modest Buying

To be sure, stocks have advanced in recent days, reversing the losses seen in early September. The S&P 500 hit a new intraday high of 5,670.81 on Sept. 17, and last week’s 4% gain was the best week for the benchmark index since October 2023. Interactive Brokers noted that popular technology stocks such as Nvidia (NVDA) and Tesla (TSLA) took the first and second positions on its weekly list of the 25 most actively traded securities.

However, the brokerage also said that in a “somewhat surprising” development, net buying among investors was “quite modest” over the past week and leading into the Fed’s pending rate decision. Indeed, net buying of Nvidia’s stock totaled 12,600 shares in the week ended Sept. 17 compared to 107,700 the previous week.

Interactive Brokers said the results show their “customers are not buying into the latest rise” in the market, adding, “Perhaps they are displaying some risk aversion ahead of the upcoming (Fed) meeting.” The U.S. central bank has not lowered interest rates since before the COVID-19 pandemic struck in 2020. Futures traders are betting that the Fed will lower interest rates a full percentage point between its policy meeting on Sept. 18 and the end of this year. The Fed funds rate currently stands at 5.25% to 5.50%.

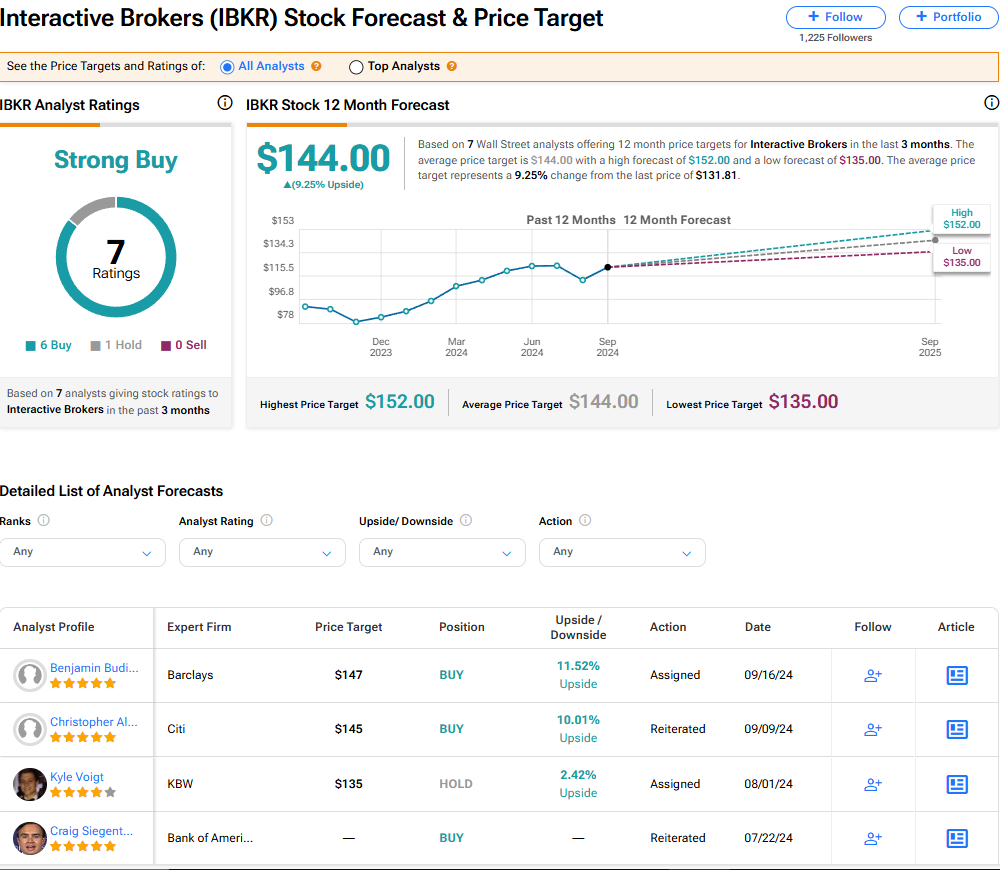

Is IBKR Stock a Buy or Sell?

The stock of Interactive Brokers currently has a Strong Buy rating among seven Wall Street analysts who cover the brokerage’s progress. There are six Buy ratings on the stock and one Hold rating. There are currently no Sell ratings. The average price target on IBKR stock of $144 implies 9.25% upside from current levels.