On Monday, Nvidia’s stock (NVDA) price plummeted by 17% due to concerns about Chinese startup DeepSeek disrupting the AI industry. However, retail investors took the opportunity to buy Nvidia shares at a lower price. In fact, according to Vanda Research, retail investors purchased a record $562.2 million worth of shares, which was the largest amount since 2014.

This surge in buying activity led to a significant spike in trading volume as over 819 million shares changed hands. This was way higher than the average daily volume of around 213 million shares. At Interactive Brokers (IBKR), the number of purchases outnumbered sales by a wide margin, with 420,900 buys compared to 213,900 sells over a five-day period.

This activity caught the attention of Interactive Brokers’ Chief Strategist, Steve Sosnick. Indeed, he described the imbalance between buys and sells as “astounding” and noted that Nvidia had become the most actively traded stock on the platform. As a result, Nvidia’s shares rallied on Tuesday as the buying momentum continued.

Is NVDA a Good Stock to Buy?

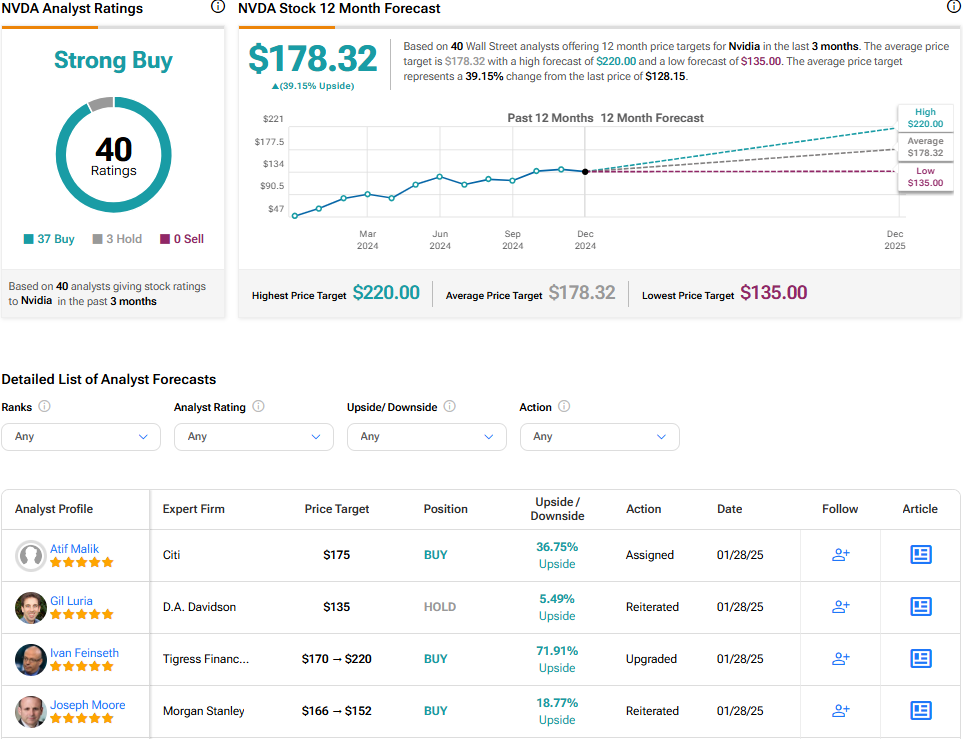

Turning to Wall Street, analysts remain bullish on NVDA stock, with a Strong Buy consensus rating based on 37 Buys and three Holds assigned in the past three months. After a 105% rally in its share price over the past year, the average NVDA price target of $178.32 per share implies an upside potential of 39.15% from current levels.