Recent news about Intel’s (INTC) Lunar Lake processors and their potential in the artificial intelligence (AI) PC market should have brought a lot more hope to investors than it did. And new word about its manufacturing plans should have bolstered hope. Nevertheless, Intel shares were down modestly in Tuesday afternoon’s trading.

While at the IFA conference in Berlin, Intel brass offered up a presentation about the Lunar Lake processor lineup and what kind of value it would have in the AI PC market. Intel did everything in its power to project confidence in the Core Ultra 200V line and, by all reports, made it abundantly clear that Intel believes in these processors.

Intel showed off significant improvements in performance delivered per watt of power used, including a reduction of system memory latency of nearly 40% against the Meteor Lake Core Ultra 100 series. Instructions Per Clock (how many tasks a computer processor can complete per clock cycle) were up 68%, and that was just the start of some impressive metrics that gave the Lunar Lake lineup a surprisingly bright future outlook.

Manufacturing Shuffle

And with Intel’s Chips and Science Act money somewhat in doubt, as we found yesterday, Intel is shaking up its manufacturing processes to save money while demonstrating that it can still make chips. The 20A process is effectively dead, reports note, but the 18A process, Intel’s best manufacturing process, is still on track to be ready to go by the end of this year. While this is a bit of a black eye for Intel, the $500 million that Intel will reportedly save by not building up the 20A process will likely prove a consolation prize.

Is Intel a Buy, Sell, or Hold?

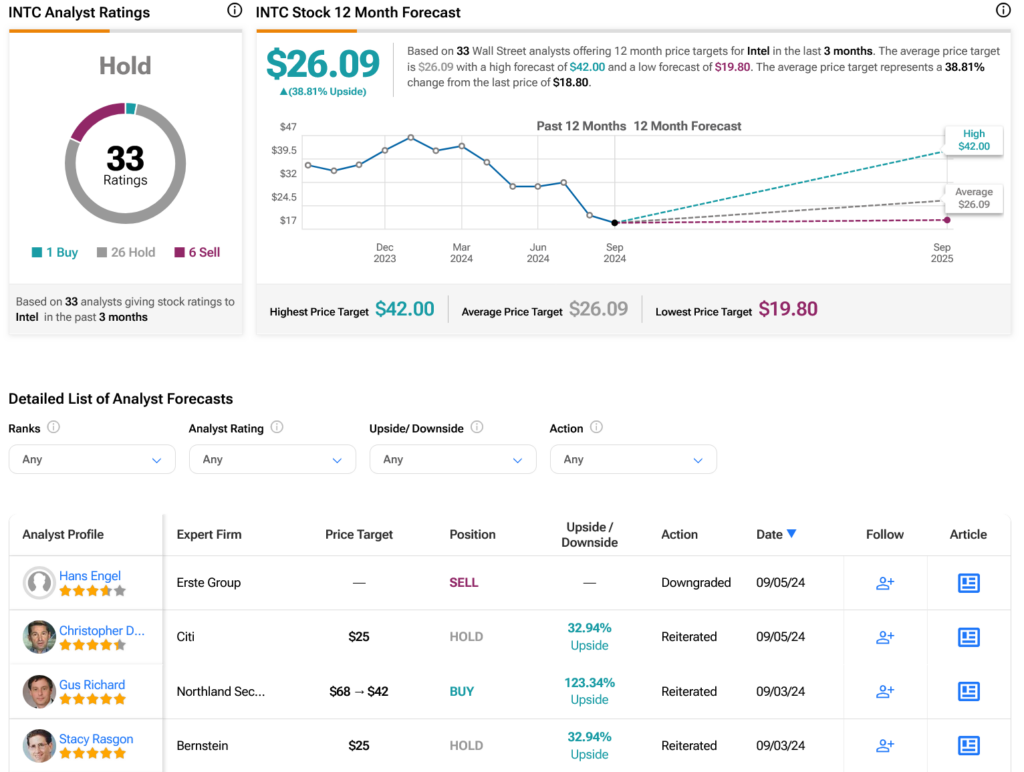

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 25 Holds, and six Sells assigned in the past three months, as indicated by the graphic below. After a 50.46% loss in its share price over the past year, the average INTC price target of $26.09 per share implies 38.81% upside potential.