Amid ongoing chip shortage challenges, Intel Corporation (NASDAQ: INTC) has unveiled the first phase of its investment plan worth €80 billion for the European Union over the next decade. The chipmaker plans to advance the semiconductor ecosystem in Europe, which includes research and development (R&D), manufacturing, and packaging capacities.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The initial plan includes an investment of €17 billion to build a massive semiconductor fab in Germany, a new R&D and design hub in France, and to establish R&D, manufacturing, and foundry services in Ireland, Italy, Poland, and Spain. Through this investment, the company aims to produce a vertically integrated ecosystem with advanced technology, which will aid in balancing the global semiconductor supply chain.

Plan in Detail

In the initial phase, Intel will build two chip plants in Magdeburg, Germany, with construction anticipated to commence in the first half of 2023. Meanwhile, Intel expects them to become operational in 2027, upon regulatory approval. These new fabs are likely to produce chips using Intel’s next-generation, Angstrom-era transistor technologies.

With the initial investment of €17 million in advanced chipmaking, Intel plans to create a “Silicon Junction,” in Germany. It is expected to create 7,000 construction jobs, 3,000 high-tech jobs for Intel, not to mention all the external work that it will provide for the region. This tech hub is anticipated to attract innovation from other companies and industries from beyond the surrounding area.

Furthermore, expanding Intel’s presence in Ireland by €12 billion, the tech company plans to double is production capacity.

Intel is currently in talks with Italy over the establishment of an innovative manufacturing plant. The company would invest another €4.5 billion for a brand-new back-end fab, creating thousands of more jobs.

In addition to its advanced manufacturing plans, Intel announced a project for an R&D space in Plateau de Saclay, France to enhance “high-performance computing (HPC) and artificial intelligence (AI) design capabilities” in Europe.

CEO’s Comments

The CEO of Intel, Pat Gelsinger, spoke on the proposed investments, stating that “The EU Chips Act will empower private companies and governments to work together to drastically advance Europe’s position in the semiconductor sector. This broad initiative will boost Europe’s R&D innovation and bring leading-edge manufacturing to the region for the benefit of our customers and partners around the world.”

Wall Street’s Take

Recently, Citigroup analyst Christopher Danely maintained a Hold rating on Intel, although he did not offer a price target.

Overall, the stock has a Hold consensus rating based on eight Buys, 13 Holds, and seven Sells. The average Intel price target of $53.90 implies 20.29% upside potential. Shares have lost 28.93% over the past year.

News Sentiment

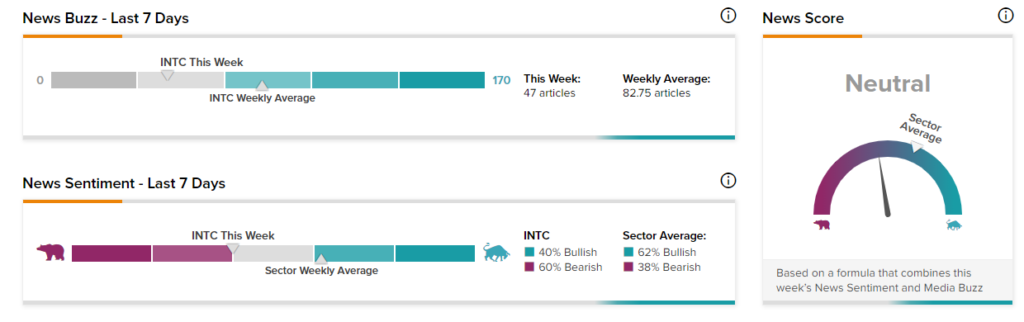

News Sentiment for Intel is currently Neutral based on 47 articles over the past seven days. 40% of the articles on INTC have a bullish sentiment, compared to a sector average of 62%, while 60% are bearish, compared to a sector average of 38%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Ford to Expand EV Footprint in Europe

Boeing Continues to Fly with New 737 MAX Orders

Moderna Begins HIV Vaccine Testing; Shares Jump