Chipmaker Intel (INTC) has faced plenty of problems, and it suffered a little more today as the Chinese government alleged that Intel has been up to some “illegal mapping” activities.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

A report from The Register noted that the Chinese Ministry of State Security is calling out Intel directly on the matter of “illegal mapping.” Also, the firms involved were alleged to have stolen undefined “state secrets.” This theft apparently resulted from Intel and Tesla’s (TSLA) partnership with a local business, where it was making maps that may have included “…high-precision measurement information such as military centers and key departments.”

Intel’s Mobileye (MBLY) offered up a statement on the matter. It noted that Mobileye “…continuously invested in data compliance and regulatory adherence, including in China, where we operate under the supervision of licensed entities in full accordance with legal requirements.”

Another Crisis

Separately, The Wall Street Journal sounded an alarm on Intel’s latest market performance, calling it “…a national crisis.” For Intel, a canceled dividend along with plunging share prices and hefty layoffs suggested that there may be greater problems than anyone expected.

And with the Chinese government also calling out Intel over backdoor access in its processors, that basically amounts to one more problem that Intel does not need right now.

Is Intel a Buy?

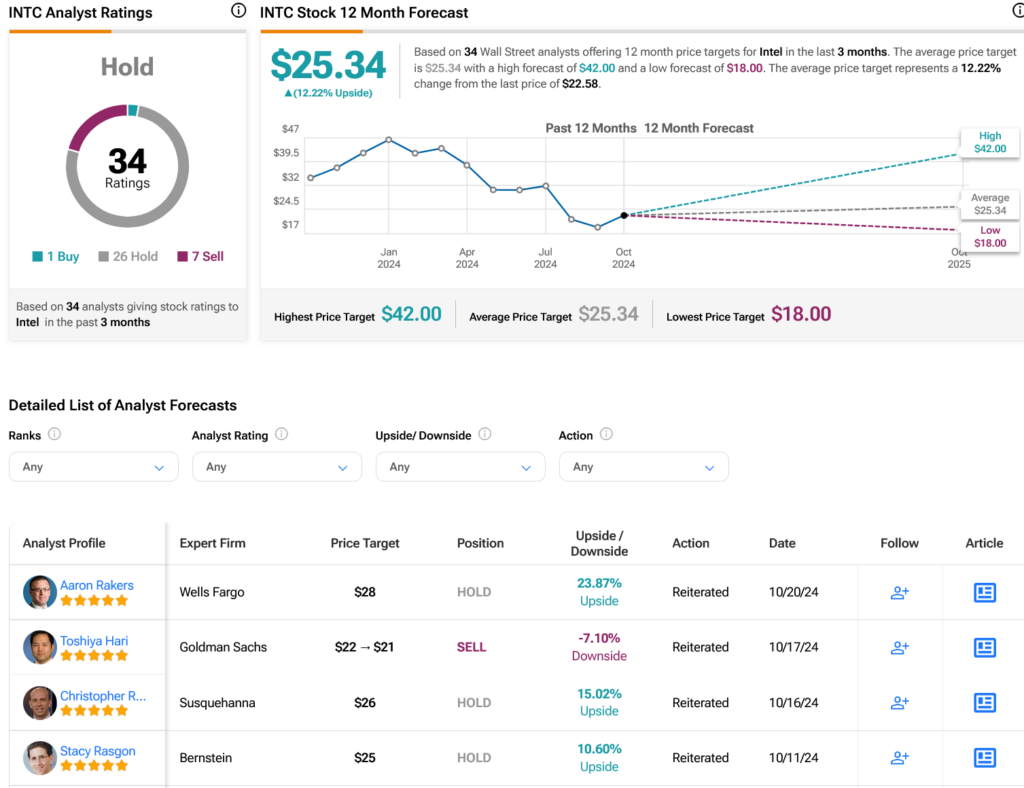

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on one Buy, 26 Holds and seven Sells assigned in the past three months, as indicated by the graphic below. After a 32.1% loss in its share price over the past year, the average INTC price target of $25.34 per share implies 12.22% upside potential.