Traditional finance titans Vanguard (NYSE:VOO) and BlackRock (NYSE:BLK) are doubling down on Bitcoin (BTC-USD) and the broader crypto space through MicroStrategy (NASDAQ:MSTR) investments. These two giant institutions have increased their exposure in MSTR, exposing them to Bitcoin’s potential. Meanwhile, other TradFi firms are also showing interest in spot Bitcoin ETFs.

Claim 50% Off TipRanks Premium and Invest with Confidence

- Unlock hedge-fund level data and powerful investing tools designed to help you make smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis so your portfolio is always positioned for maximum potential

TradFi’s Big Bitcoin Bets

On May 10, Vanguard and BlackRock revealed significant increases in their stakes in MicroStrategy. Vanguard now holds 1.6 million MSTR shares worth $2.6 billion, up from 1.2 million shares worth $727.6 million at the end of December 2023. BlackRock’s holding rose to 1.2 million shares valued at $2.1 billion from 1.0 million shares worth $646.4 million last quarter.

MicroStrategy, a business intelligence firm turned Bitcoin developer company, has been on a buying spree. The company reported acquiring $1.65 billion worth of Bitcoin in the first quarter, bringing its total holdings to 214,400 BTC. The trend isn’t limited to MicroStrategy. Data from Fintel shows that at least 750 firms have invested in MSTR, seeking exposure to Bitcoin through its holdings. Meanwhile, the interest in spot Bitcoin ETFs is also heating up.

Bitcoin ETFs: TradFi’s New Frontier

Recent 13F disclosures reveal that major banks and investment firms are betting on spot Bitcoin ETFs. On May 13, Swiss bank UBS (NYSE: UBS) invested $145,692 in BlackRock’s IBIT (NASDAQ: IBIT). Other significant players, such as JP Morgan (NYSE: JPM), Wells Fargo (NYSE: WFC), and BNP Paribas (BNPQY), have also reported spot Bitcoin ETF investments in the first quarter.

In its latest disclosure, Wolverine Asset Management revealed that it is one of the largest holders of Fidelity’s FBTC-USD, with a $54 million investment. Fintech firm Envestnet reported a $62 million stake in various spot Bitcoin ETFs, including FBTC (NASDAQ: FBTC), GBTC (NYSE: GBTC), ARKB (BATS: ARKB), IBIT , and BITB (NYSE: BITB). Crypto investment firm Multicoin Capital revealed an investment of $83.5 million in Grayscale’s GBTC, placing it among the largest GBTC holders.

As of May 13, spot Bitcoin ETFs collectively manage $52.4 billion in assets. They have seen inflows of $11.7 billion since May 10.

Is Bitcoin a Buy?

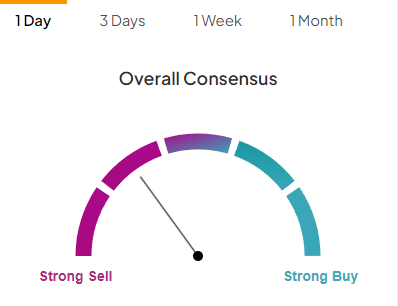

According to TipRanks’ Summary of Technical Indicators, Bitcoin is a Sell.

Don’t let crypto give you a run for your money. Track coin prices here.