Aurora Innovation’s (NASDAQ:AUR) more-than-10% owner, Uber Technologies (NYSE:UBER), recently increased its stake in AUR by $75 million. Aurora develops cutting-edge technology to power autonomous vehicles. Shares of the company gained about 3% in Friday’s extended trading session.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

It is worth noting that in December 2020, Aurora acquired Uber’s self-driving unit to accelerate the development of Aurora’s self-driving technology, Aurora Driver. Since then, Uber has been a major shareholder in AUR.

As per the SEC filing, Uber bought 25,037,036 shares of Aurora on July 21, 2023, at an average price of $2.99 per share. Interestingly, Uber’s total investment in AUR stock now stands at nearly $802 million.

Hedge Funds Are Bullish on AUR

Also, the hedge fund managers remain bullish on Aurora stock.

The Hedge Fund signal remains Very Positive for Aurora stock. TipRanks data shows that hedge funds bought 4.2 million shares of the company last quarter, with Soros Fund Management’s George Soros and EntryPoint Capital’s Andrew Alkon increasing their holdings in AUR stock.

What Is the Price Target for AUR?

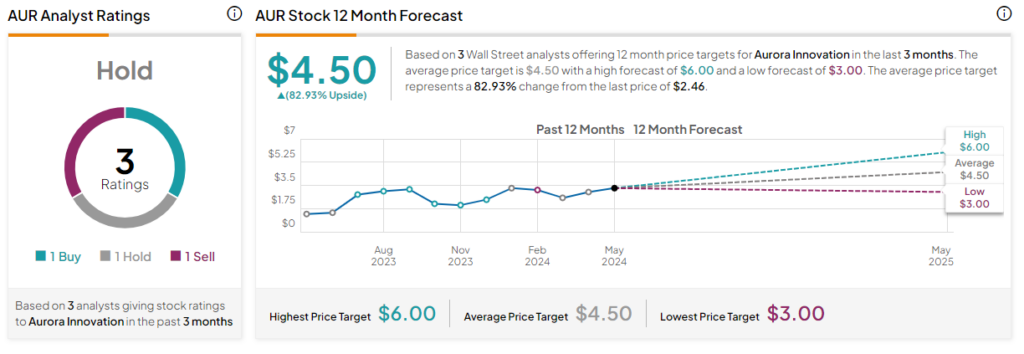

Overall, on TipRanks, AUR has a Hold consensus rating based on one Buy, one Hold, and one Sell rating each. The analysts’ average price target on AUR stock of $4.50 implies an 82.93% upside potential from current levels. Meanwhile, AUR stock has gained 13.9% over the past six months.